2023/09: Watchlist Updates and Recent Moves

Newlat Food $NWL, Endava $DAVA, Learning Technologies Group $LTG, Spyrosoft $SPR.WA, Solutions 30 $S30

In our September 2023 watchlist update, we're sharing the latest developments from various companies, including: Newlat Food $NWL, Endava $DAVA, Learning Technologies Group $LTG, Spyrosoft $SPR.WA, Solutions 30 $S30

RECENT MOVES

Increased Investments: Information Service Corp ($ISV), Nagarro ($NA9), Société Informatique Industrielle ($SII), Walt Disney ($DIS), Verallia ($VRLA), GoEasy ($GSY)

Buys: Spyrosoft ($SPR.WA)

Sells: Micron ($MU)

SIGNIFICANT DEVELOPMENTS

Newlat Food ($NWL) - H1 Results in Line with Guidance

Newlat Food unveiled its H1 results (→ link), and the market responded positively, witnessing a nearly 10% surge of the share price on the day of the presentation. However, the shares have since fallen back to the pre-presentation level, a typical trend during bear markets.

The results presented by Newlat Food are not only in line with their previously communicated guidance but have also exceeded expectations. This performance has bolstered management's confidence in their ability to achieve their objectives, which include:

Achieving double-digit sales growth.

Maintaining a healthy EBITDA margin of 9%.

Generating a robust free cash flow (FCF) of over 30 million.

Significantly focusing on mergers and acquisitions (M&A) activities. It's worth mentioning that the company had previously hinted at potential acquisitions with annual sales worth 1 billion in the UK and several others in Europe ranging from 50 million to 200 million.

The company is currently trading at a very attractive valuation, EV/EBITDA ratio of 4-5x for the year 2023.

Endava ($DAVA) - Unpacking the Latest Numbers and Outlook 2024

Endava presented its financial performance for Q4 and FY2023. Here are the key takeaways:

Q4 FY2023 Highlights:

Revenue: £189.8 million (+5.2% compared with Q4 2022)

Diluted EPS: £0.40 (-15%)

Adjusted EPS: £0.56 (+11%)

FY2023 Highlights:

Revenue: £794.7 million (+21.4% surge compared to 2022)

Diluted EPS: £1.62 (+13%)

Adjusted EPS: £2.28 (+18%)

Outlook for 2024:

Revenues in the range of £780 to £795 million (potential decline of -2% to 0%).

Adjusted diluted EPS in the range of £1.52 to £1.62 (30% decline).

Delays in client projects persist due to the uncertain macroeconomic climate.

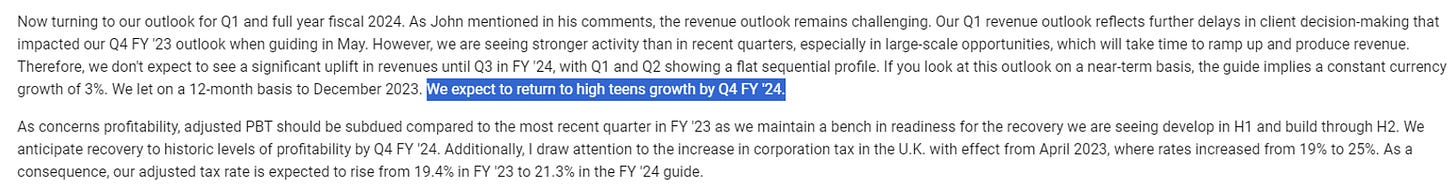

During the conf call they extended about the project cancelations and delays, and mentioned they expect to come back to high teens growth by Q4 FY24, which does not really match their guidance, so that I didn't really took into account in my update. I updated my model as follow:

Revenue projections for FY24 +0%, FY25 +10%, and FY26 +20%—note that these figures are lower than the historical growth rate of >30%.

A slight decrease in EBIT margin.

An effective tax rate of 21%, following the increase in corporate tax in the UK.

The result is, as usual, displayed in the watchlist table below. If you're interested in the specific Excel model of Endava, feel free to inquire.

Learning Technologies Group ($LTG) - H1 Report and Recent Updates

Learning Technologies Group released their financial results, which were consistent with their last trading update. The company's recurring revenues, driven by SaaS (Software as a Service) and long-term contracts, continue to show resilience and are now accounting for 72% of their revenues. However, they have been grappling with a challenging macroeconomic environment affecting transactional revenues.

Of note, the situation in China and Japan has been deteriorating.

Looking ahead to FY2023, the company expresses confidence in meeting the analysts' consensus (table herebelow). For more detailed information, you can refer to their official press release.

Additionally, the CEO of Learning Technologies Group participated in a brief interview with Proactive Investors a few days after the results presentation. You can watch the interview here.

Spyrosoft ($SPR.WA) - Navigating Preliminary H1 2023 Results

Spyrosoft recently unveiled their preliminary results for the first half of 2023, and it came as a bit of a surprise when the stock price took a nearly 10% dip. Let's break down the key highlights:

Sales revenue soared by 47%, reaching PLN 205 million, outpacing expectations.

EBITDA Decrease: declining by 8% to PLN 20.5 million.

EBITDA Margin at 10%, just below their guidance range of 11%-14%.

The substantial revenue growth exceeded the targets set in the company's 2022-2026 strategy, demonstrating a clear path of expansion. But the decline in margins was attributed to a few factors:

Investments and International Expansion: Spyrosoft has been investing in teams and expanding internationally, a move that impacted profitability due to reduced demand for IT services in the midst of a global economic slowdown.

Currency Fluctuations: Additionally, exchange rate fluctuations, particularly the strengthening of the Polish zloty, had a negative impact on EBITDA.

As for my personal stance, I've decided to cautiously re-enter the market with a small position at 400 PLN, and I'm considering increasing it if the stock continues to trend downward. Earlier this year, I had previously sold my entire position when the stock was trading above 600 PLN.

For those who want to delve deeper into the details, you can access the full preliminary report here.

Solutions 30 ($S30): Oportunity or value trap?

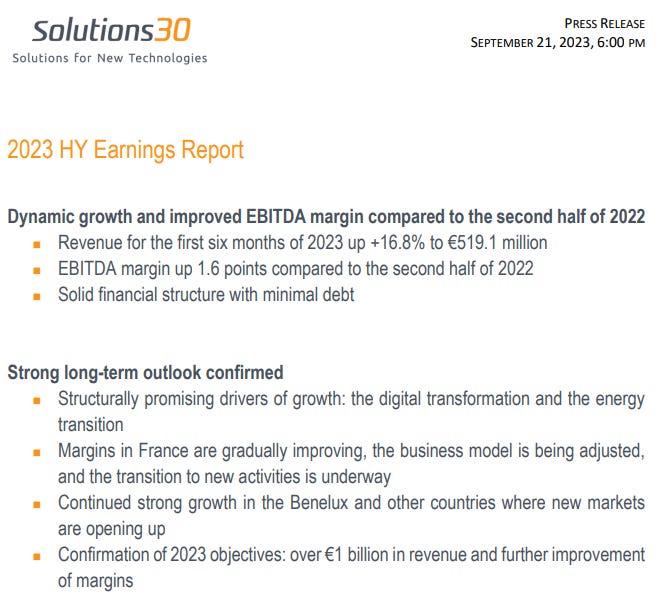

Solutions 30 unveiled in September its H1 report, accompanied by a significant announcement—a strategic partnership with Q Energy for the development of the largest floating solar farm. Here are the key takeaways from the report:

Revenue jumped by 16.8% compared to last year.

EBITDA Margin Gets Better: Their EBITDA margin is now 5.3%, up by +1.6% from 2022. But it's still below their usual margin, which used to be more than 10%.

2023 Looks Bright: Solutions 30 is sticking to their goal of making over 1 billion in revenue this year, and they think their margins will get even better.

For those seeking in-depth details, you can access the full H1 report here, and the partnership announcement with Q Energy can be found here.

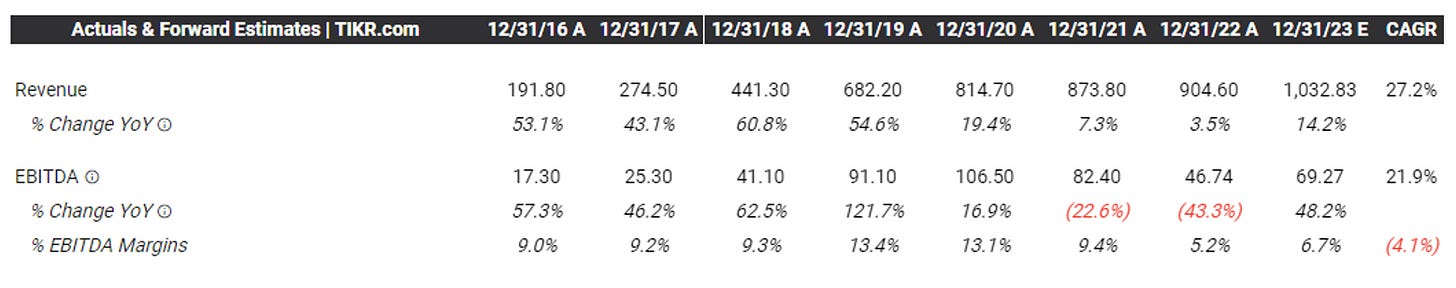

But here's the catch: Despite the company's impressive financial growth, its stock price dropped by nearly 20% after the report. What's more, the stock is now trading at 4x EV/EBITDA, same level as in 2016, even though the company has seen significant growth:

Revenue increased by 500%.

EBITDA went up by 400%.

Company insiders own 16% of the shares, get low salaries, and have not diluted the stock.

In the short term, Solutions 30 aims to achieve sales exceeding 1 billion, with an expected EBITDA margin of 10%. Looking ahead, their goals for the next 5-10 years are ambitious: surpassing 2.5 billion in sales and achieving a profit margin of 15%. This means they plan to keep growing at a rate of 10-20% in sales and 15-30% in earnings over the next decade. If they manage to achieve their plan, they would be trading now at less than 1x EV/EBITDA!

Oportunity or value trap?

OTHER READS

Rob Vinall (RV Capital) shared its H1 Letter

They reduced holdings in Credit Acceptance ($CACC) and Prosus ($PROSY) and added Interactive Brokers ($IBKR). Also, they increased their bets on Meta Platforms ($META) and Ryman Healthcare ($RYMCF).

They talk about why they invested in Interactive Brokers ($IBKR), mentioning their financial strength, market presence, and cost advantage.

Unlocking the Strategies of Europe's Top Fund Manager: William Higgons - Exploring Independence et Expansion Fund's Wealth-Building Wisdom

WATCHLIST