2023/10: Watchlist Updates and Recent Moves

Verallia ($VRLA), FlatexDegiro ($FTK), EuroApi ($EAPI), Aubay ($AUB), STMicroelectronics ($STM), Kontron ($SANT), MTY Food ($MTY), SS&C ($SSNC),Tencent ($TCEHY), Alibaba ($BABA), Digital Value ($DGV)

Hello everyone,

I hope this update finds you well. I've been traveling extensively in Asia for business purposes during this last month, so that I will make this one shorter than usual but I promise equally informative.

RECENT MOVES

Sells: Tencent ($TCEHY), Alibaba ($BABA), Spyrosoft ($SPR.WA)

As mentioned earlier, I've been gradually divesting from my Chinese stock holdings, and I've completed the process, putting an end to a somewhat disappointing investment chapter. My experience with Alibaba resulted in a significant loss of 32%, while Tencent yielded a modest positive return.

My initial investment thesis was straightforward. Having lived in China for almost a decade and used their services daily, I found these companies incredibly undervalued compared to their western peers. However, over time, the landscape changed, and they no longer seemed as appealing.

If we look at the numbers of 2019, what I was looking at when I initiated these investments, these companies boasted impressive financials. Yet, since then, their growth rates, profit margins, ROE and other critical metrics have experienced a significant decline year after year. Particularly with Alibaba, I observed a lack of commitment to creating value for shareholders.

I am more than glad to be moving on from this business. There are significant lessons to be taken from investment mistakes, which unfortunately, can be great teachers.

As for Spyrosoft, I initiated a small position last month, but I promptly exited it after a quick rebound with a minor profit. There were certain aspects in their recent report that raised some doubts, while there are numerous options on my radar, and I'll be sharing some of them shortly in this post.

Buys: Digital Value $DGV

I've been keeping an eye on Digital Value since its IPO, thanks to @fersan_7. They've consistently delivered impressive results over the years. Recently, I took a position in this stock as it had dropped more than 60% from its 2021 peak and was trading at just 5 times EBITDA.

Digital Value is an Italian-owned company specializing in Information and Communication Technologies (ICT) infrastructure. They serve both public and private entities in Italy and operate in three key areas:

Data Centers (50%): They're involved in designing, reselling, and implementing data centers.

Digital Business Transformation (30%): This segment focuses on digital engineering, similar to companies like SII and Aubay.

Smart Workplace Transformation (20%): Here, they sell, install, and maintain IT equipment.

While the last two sectors have faced challenges this year, the data center segment continues to grow at a strong rate of 50%. As a result, they're expected to achieve nearly 20% growth this year.

The company is outpacing its peers in growth, with insiders showing strong alignment by owning over 60% of the company. Furthermore, DGV boasts an exceptional ROE of greater than 25%.

There are some risks to be aware of compared to similar companies in my portfolio:

Focus only on Italy, which is a risk, but also an opportunity, it is a country very poorly digitalized.

Customer concentration: Highly exposed to Central & Local Government clients (35/40% of revenues) as well as a single player in the Telecom segment (20-25%). Top 10 clients account for about 60/70% of total revenues.

Very volatile small cap with limit track record

M&A execution risk (and opportunity): Italian ICT market is strongly fragmented by very small and local operators.

Increased investments: Teleperformance ($TEP), Solutions 30 ($S30), Dye & Durham ($DND), EuroApi ($EAPI), Titanium Transportation Group ($TTNM).

SIGNIFICANT DEVELOPMENTS

Verallia ($VRLA) reported Q3 results that met expectations and reaffirmed its 2023 guidance.

FlatexDegiro ($FTK) presented strong Q3 results, with impressive revenue and earnings growth, alongside margin improvements. The stock initially surged over 10% post-presentation, although it currently hovers below the pre-presentation levels. My main takes are:

Reaffirmation of their full-year guidance, which I believe is quite conservative. There's a high likelihood that they might pleasantly surprise investors at the end of the year.

Approval from BaFin for FTK's credit mitigation techniques, leading to a substantial reduction in risk-weighted assets (RWA) and creating a regulatory capital surplus of about EUR 100 million.

Plans to bolster their options offering over the next 12 months, addressing a specific area of interest. I believe many investors chose to leave Degiro due to the limitations in this regard.

Commitment to improving their Crypto and ETP offerings, aiming to cater to a broader range of investors.

EuroApi ($EAPI) issued a profit warning and abandoned its long-term objectives, as I had anticipated in my previous post. Later this month, the CEO stepped down. While 2024 is expected to be a challenging year for all companies in the sector, with lower or no growth, it's important to note that the sector itself is inherently stable. The projects are not being canceled but rather postponed. Demand is likely to rebound once financing terms ease. In my view, the management could have communicated more effectively, and given their limited cash flow generation, a reevaluation of their projected CAPEX may be necessary. Nevertheless, the extent of the correction appears excessive.

Aubay ($AUB) provided a trading update, cautiously adjusting its full-year revenue guidance by -1.8% and reducing its operating margin from 10% to 8.5%. This was due to a slowdown in project commitment rates, leading to a 13% stock correction. I am closely monitoring the company and considering opening a new line.

STMicroelectronics ($STM) reported Q3 results that exceeded expectations. However, they anticipate a challenging Q4. Their full-year results are expected to align with their mid-point guidance.

Kontron ($SANT) secured four significant projects worth 125 million euros and announced a new small acquisition, Bsquare ($BSQR). I didn't have the opportunity to thoroughly examine the details of the latter, however, the company is rather unusual and I'm keen to learn more during their next conference call.

MTY Food ($MTY) presented robust Q3 results, with improvements across various metrics. Despite these strong results, the entire sector is experiencing a correction, and MTY was no exception.

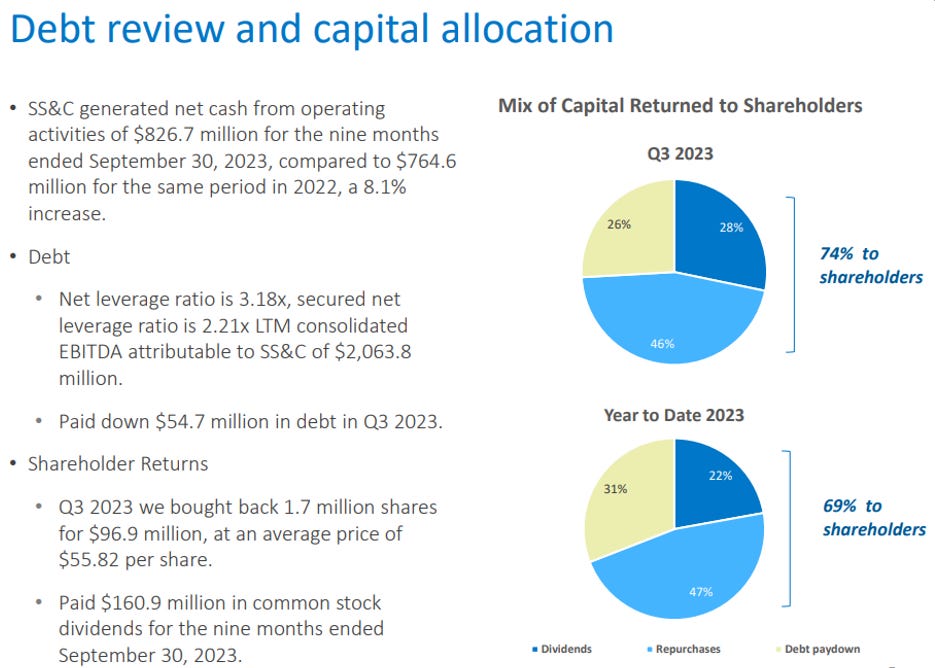

SS&C ($SSNC) disclosed Q3 results in line with their earlier guidance. They provided a more precise range for their FY guidance, indicating that it will likely fall within the lower end of the previously announced range. However, Thanks to their aggressive share buybacks, EPS is on track to outperform expectations.

WATCHLIST