2023/11: Watchlist Updates and Recent Moves

SII Group ($SII), Kontron ($SANT), Information Service Corp ($ISV), Titanium Transportation Group ($TTNM), NewLat ($NWL), GoEasy ($GSY), Berry Global ($BERY)

November stood out as an exceptional month for my portfolio. It delivered an impressive performance, surging by 12.1%, marking the best month since April '20. The year-to-date performance is strong at 22.6%. Despite these exciting numbers, the month was relatively quiet in terms of activity. Nevertheless, a new position was initiated.

RECENT MOVES

Increased Investments: GoEasy ($GSY)

Buys: Eurofins Scientific ($ESF)

Sells: none

Eurofins Scientific is a gloal leader in the laboratory testing industry, consolidating its position through years by acquiring and integrating laboratories. As a family-owned business, its management is closely aligned with shareholders. Over the last 30 years, Eurofins has consistently delivered steady returns and high ROE (in the range of 15%-20%). I'll be sharing more about this company in an upcoming post.

SIGNIFICANT DEVELOPMENTS

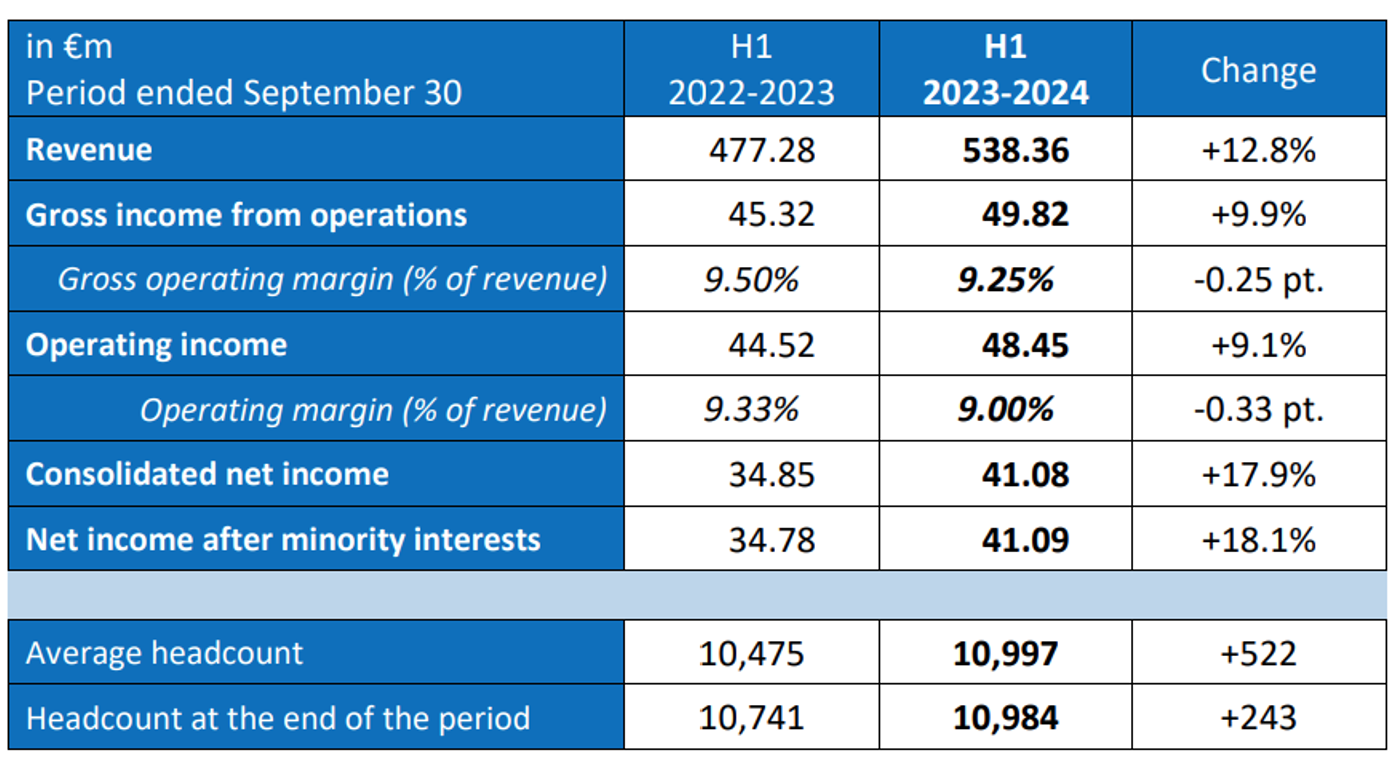

SII Group $SII

SII published their 2023/24 H1 results, surpassing the previously provided guidance with a notable growth of 12.8%. Operating margins reported were in the lower range at 9.1%. The detailed report, available here, provides a comprehensive overview.

Despite these excellent results, SII acknowledges low visibility in their current business environment. They plan to keep stakeholders informed by regularly updating their guidance quarter by quarter.

Kontron $SANT

Kontron (SANT) reported robust results for the third quarter of 2023, prompting an upward revision of their FY2023 guidance. My main takeaways are:

The company is already surpassing net income levels, prior excision of their IT business, so that I agree “Kontron’s strategic realignment is a resounding success” quoting M. Niederhauser, CEO of Kontron.

Strong order intake, exceeding industry peers, with a noteworthy book-to-bill ratio of 1.19. The backlog stands at an impressive 1.7 billion, with particular strength observed in the Software Solutions segment (book-to-bill >2).

They are actively integrating three recent M&A transactions.

They still have over 350 million in available liquidity, so that they are well positioned for future M&A initiatives. Apparently, there are on going negotiations and they will soon announce new acquisitions.

Kontron approved a new share buyback program, allowing for the repurchase of 6.3% of total shares (max 70 million).

They consistently emphasize their goal of reaching $2 billion in sales by 2025. However, I remain conservative in my projections, considering a target attainment by 2027-2028 in my model.

For more detailed information, you can refer to Kontron's official report.

Amiral Gestion reduced its stake from 5% to 4%, yet it remains among the top five positions in their portfolio.

Information Service Corp $ISV

Information Services Corporation (ISV) released their Q3 results, aligning with their guidance.

Despite the challenging business environment, all segments, including Registry, Services, and Technology solutions, continue to experience growth. The company reported a significant 12% year-over-year increase in revenue. However, net margins declined, impacted by higher interest rates and increased debt levels. This dip in net margins can be attributed to the down payment made in July following the extension agreement, securing ISV's exclusive right to manage and operate the Saskatchewan registries.

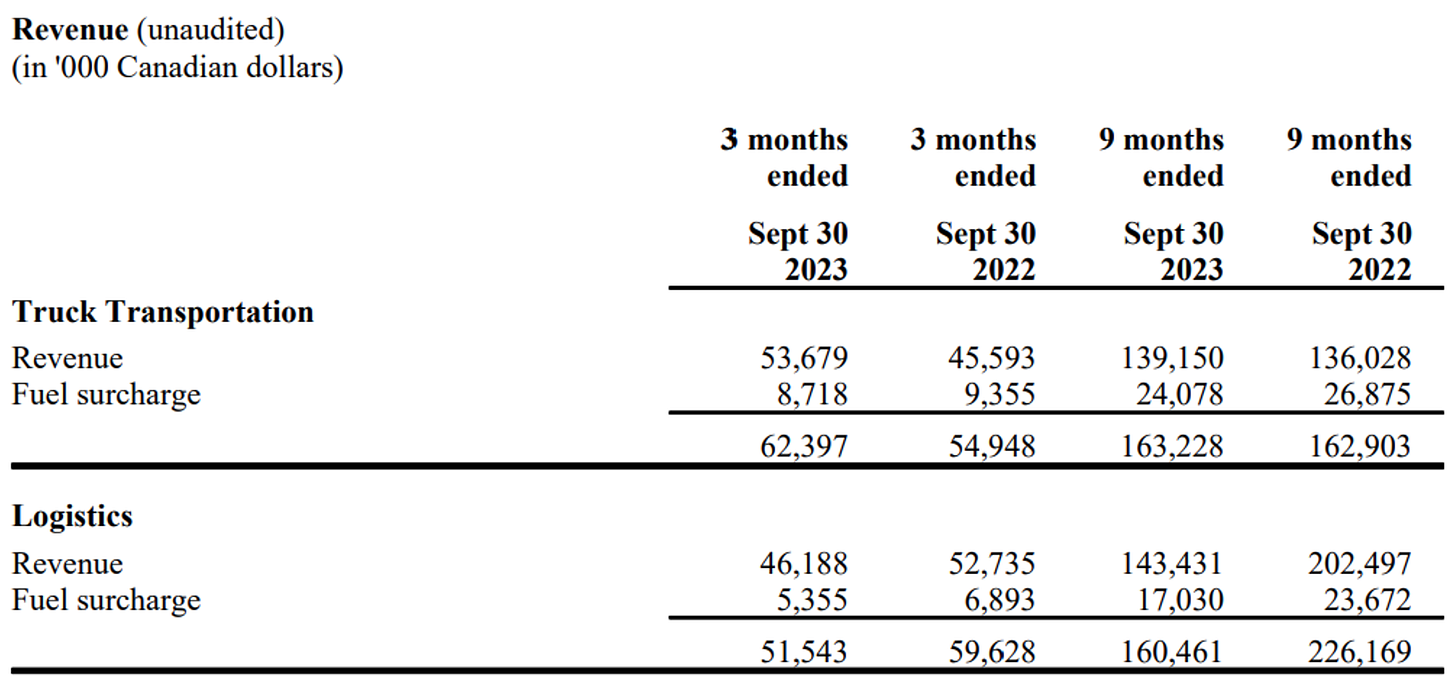

Titanium Transportation Group $TTNM

Titanium Transportation Group (TTNM) has once again reported a profitable quarter, demonstrating resilience in the face of challenges within the freight market. Notably, they provided additional insights into their latest acquisition, Crane Transport, highlighting its significance for their expansion in the US. Despite experiencing a temporary impact on margins post-acquisition, the company expressed satisfaction with the integration pace.

The current soft market conditions resulted in volume decreases in the Truck Transportation segment and pricing decreases in the Logistics segment:

In the Truck Transportation segment, revenue increased by 13.6% during the quarter compared to the same quarter in 2022. However, over the nine-month period ending September 30, 2023, the growth was 0.2%. The segment faced challenges such as a 6% year-over-year decrease in freight volumes and a decline in fuel surcharge revenue due to the decrease in diesel fuel prices. The recent acquisition of Crane injected $14.4 million, partially offsetting the decrease in revenue.

The Logistics segment experienced a 13.6% decrease in revenue for the three-month period ending September 30, 2023, and a 29.1% decrease for the nine-month period compared to 2022. Despite a 13.4% decrease in pricing year over year, the segment achieved over 6% growth in volume, showcasing the positive impact of the company's strategic investments in new locations.

Amid these market dynamics, Titanium Transportation Group adjusted their revenue guidance from $450-$470 million to $430-$450 million, with an EBITDA margin of 10.5% to 12.5%.

Apologies for delving into these numbers, but what I want to highlight is that despite the current macroeconomic challenges, including lower volume and pricing pressures, the company has weathered the storm. They successfully maintained their margins and sustained both organic and inorganic growth. The anticipated rebound, likely to occur at the second half of 2024 or the beginning of 2025, holds the potential for significant positivity and benefits. I wouldn't be surprised if they announce new acquisitions soon.

For a more detailed review, you can refer to Titanium Transportation Group's official report.

NewLat $NWL

NewLat Food (NWL) presented robust results that align with their performance throughout the year—achieving a commendable growth rate of 15% and witnessing the recovery of margins. Moreover, the company disclosed ongoing discussions about several potential acquisitions.

During the conference call, it was mentioned that out of the 15% growth, 5% could be attributed to volume increases, while the remaining 10% resulted from price hikes.

For a detailed overview, you can refer to NewLat Food's official report.

GoEasy $GSY - Timeless Truth: Another Record Quarter for GoEasy

No matter when you read this, it holds true: GoEasy has achieved a new record quarter. My takes:

Their commitment to surpassing the guidance for 2023.

Q3 EPS growth rate of 29%, and 20% for 9M.

A notable decrease in delinquency rates.

Expanding margins despite the challenging backdrop of increased interest rates.

Looking forward, they anticipate sustaining a 20% annual growth with a low debt profile. Currently trading at a P/E ratio of 8x for 2024.

Berry Global $BERY

Berry Global presented their Q4 and FY23 results, revealing several noteworthy achievements and strategic moves. Here are my key takeaways:

Record-Breaking Performance: Despite challenging market conditions marked by lower volumes and price reductions due to the resin market, Berry Global set another record for adjusted earnings per share and surpassed their free cash flow guidance by $100 million.

Capital Return to Shareholders: Demonstrating a commitment to shareholders, the company returned $728 million of capital. This included $601 million in shares repurchased, equivalent to approximately 8% of the shares outstanding, and dividend payments totaling $127 million.

Leverage Management: Berry Global ended the period with a leverage of 3.7x, and they plan to proactively address this in FY’24. The company aims to repay debt targeting an ending leverage of 3.5x or lower, aligning with their long-term target of 2.5x-3.5x.

Pricing and Cost Actions: In response to market challenges, Berry Global took proactive pricing and cost actions, resulting in a positive price/cost of $168 million in FY’23. Moreover, they anticipate a carry-over benefit of $55 million or more in FY’24.

Dividend Increase: Reflecting confidence in their financial position, Berry Global increased the dividend by 10%, establishing a new annualized rate of $1.10 per share.

Strategic Investments: The company is strategically investing in the health care, personal care, beauty, and food sectors. These markets offer not only higher margins but also higher growth potential (HSD).

They also provided their guidance for FY2024, which I have already integrated in my model.

Remarkably, despite this strong performance, it's surprising that the company is currently trading at a PE ratio of only 8x.

WATCHLIST UPDATE

OTHER READS

I would like to conclude this post with a small tribute to Charlie Munger. If you're reading this, you're probably aware of his passing and the impact he had in the investing world. Beyond his professional achievements, many might not know that he was also known for his extensive System of Mental Models, which served as a great inspiration for me.

For a deeper understanding of Charlie's Mental Models, I recommend the following playlist curated by @TheSwedishInvestor: Charlie Munger's Mental Models Playlist

Here are a few quotes from Charlie that have left a lasting impression on me:

“Remember that reputation and integrity are your most valuable assets—and can be lost in a heartbeat.”

"The first rule of a happy life is low expectations."

"The big money is not in the buying or selling, but in the waiting."

"It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent."

“I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than they were when they got up and boy does that help, particularly when you have a long run ahead of you.”

“We all are learning, modifying, or destroying ideas all the time. Rapid destruction of your ideas when the time is right is one of the most valuable qualities you can acquire. You must force yourself to consider arguments on the other side.”

“How to find a good spouse? -the best single way is to deserve a good spouse.”

“We both (Charlie Munger and Warren Buffett) insist on a lot of time being available almost every day to just sit and think. That is very uncommon in American business. We read and think.”

“To get what you want, you have to deserve what you want. The world is not yet a crazy enough place to reward a whole bunch of undeserving people.”

"In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time — none, zero. You’d be amazed at how much Warren reads–and at how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.”

“Mimicking the herd invites regression to the mean (merely average performance).”

“A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. And that is why we say that having a certain kind of temperament is more important than brains. You need to keep raw irrational emotion under control. You need patience and discipline and an ability to take losses and adversity without going crazy. You need an ability to not be driven crazy by extreme success.”

“If something is too hard, we move on to something else. What could be simpler than that?”

“All I want to know is where I'm going to die so I'll never go there.”

As we mourn the loss of a true icon, let's honor Charlie's memory by embodying the principles he passionately believed in — rational thinking, continuous learning, and a commitment to making the world a better place.

Rest in peace, Charlie Munger. Your legacy will forever inspire us.

Kind regards,

Guybrush