Hello everyone!

Here’s a quick update on my portfolio's performance over the last quarter.

My portfolio remained flat this quarter, with a year-to-date (YTD) increase of about 1.5%, still underperforming the indexes this year.

Check out this graphic I found in twitter illustrating the performance by company size:

Or this one shared by @CharlieBilello: S&P500 vs S&P Small Caps

While mega-cap stocks have been the best performers in my portfolio for several months, the rest have shown the opposite trend.

As I’ve mentioned before, I don't usually focus on monthly or quarterly returns. However, I’m slightly reducing my exposure to large mega caps and increasing my exposure to value and small caps. In Q1, I had already slightly reduced my Amazon position, and in Q2, I did the same with Alphabet, a trend that will continue this quarter.

PORTFOLIO CHANGES:

New Additions: None.

However, I anticipate I have already added again Aubay $AUB in Q3.

Sells: Newlat Food $NWL

I decided to sell Newlat completely following the acquisition of Princess. The company experienced an impressive rally of +100% since the announcement, but I only capitalized on part of it as I opted to sell relatively soon after the acquisition was announced. As I mentioned in my previous post, if the acquisition unfolds as management and the published analyst reports (paid by NewLat BTW) suggest, investors will be quite pleased.

However, my experience working in a chemical company that grows through acquisitions has given me some insights. While I'm not directly involved in acquisitions, I do play a role in realizing the "synergies." I've seen firsthand that a lot can go wrong in these integrations, both as a corporate engineer and as an investor. Models that work well in one company might not be valid for another.

Newlat has successfully integrated smaller acquisitions in Italy worth €50-200 million, but integrating a company more than three times its size, with much lower margins and adding 31 new sites to their existing 15, is a different challenge altogether. Princess is a UK-based company, whereas Newlat is Italian, with a lot of family involvement in management and completely different culture. Many mergers and acquisitions (M&A) do not go as smoothly as management wishes, and the complexities only increase with the size of the acquisition.

Newlat’s management has made promises in the past that they didn’t fulfill, and frankly, this latest one seems particularly ambitious: They have paid 7x EV/EBITDA, which they claim will reduce to 5.2x with immediate synergies—that's €180 million in synergies just like that. In addition, the current debt levels should be between 4-5x Net Debt/EBITDA, yet they plan to be at 2.5x EBITDA in just six months. This means they expect to reduce their debt by more than €300 million in only half a year, which, from my point of view, seems pretty unrealistic for a company with such low margins.

Furthermore, I've recently observed that the company is being aggressively promoted by certain accounts, including the company itself, which announced a “conservative scenario” of €5 billion in revenue and a 10% EBITDA margin by 2030. The CFO has already announced plans for new M&A targets (with this level of debt?), and they didn’t stop buying back shares after the adquisition. This kind of hype raises red flags for me. While I hope I am wrong, I probably was by selling so early, I believe it's wise to remain cautious, especially for those who are entering the stock recently.

Portfolio Adjustments:

I've strongly increased my stake in Teleperformance $TEP. I also increased my stakes in Titanium Transportation Group $TTNM, Endava $DAVA, Eurofins $ERF, and Solutions 30 $S30.

I've discussed Teleperformance $TEP, Titanium Transportation Group $TTNM, and Endava $DAVA multiple times, and I still believe they are highly undervalued.

Eurofins $ERF was targeted by a weak short report from Muddy Waters, which I saw as a buying opportunity at around €40.

Despite solid results, Solutions 30 $S30 was hit hard after being expelled from the SBF120 index and the general downturn in the French market. I increased my stake at the level of €1.4-1.5, at 2x EV/EBITDA.

I slightly reduced my stakes in Alphabet $GOOGL and Goeasy $GSY. There were no specific reasons for these reductions; I simply chose to reallocate funds to opportunities with higher potential right now. These stocks have had significant rallies in recent months and remain among my largest holdings. I reduced my position in Alphabet further this week (in Q3).

I anticipate a few more sales or position reductions next quarter as I’m buying my first property in Switzerland. I'll try to publish the tale of my first property investment in Switzerland soon!

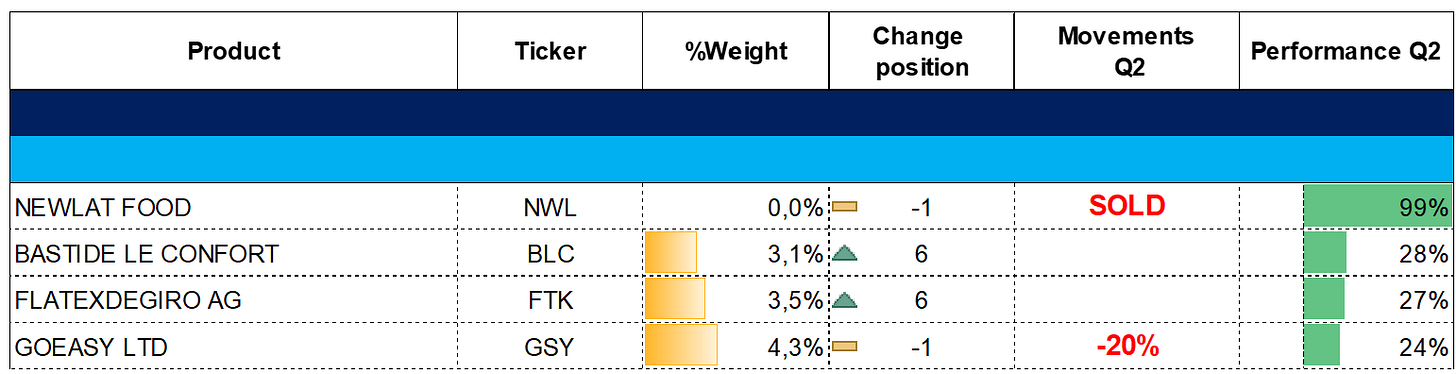

Best Performers:

This quarter, a few stocks stood out in my portfolio:

Newlat Food $NWL: Acquisition of Princess.

Bastide Le Confort $BLC: Solid Q1 results. Benefited from interest rate cuts.

Flatexdegiro $FTK: Strong Q1 results and above-expectation guidance.

GoEasy $GSY: Continued strong performance and record Q1 results.

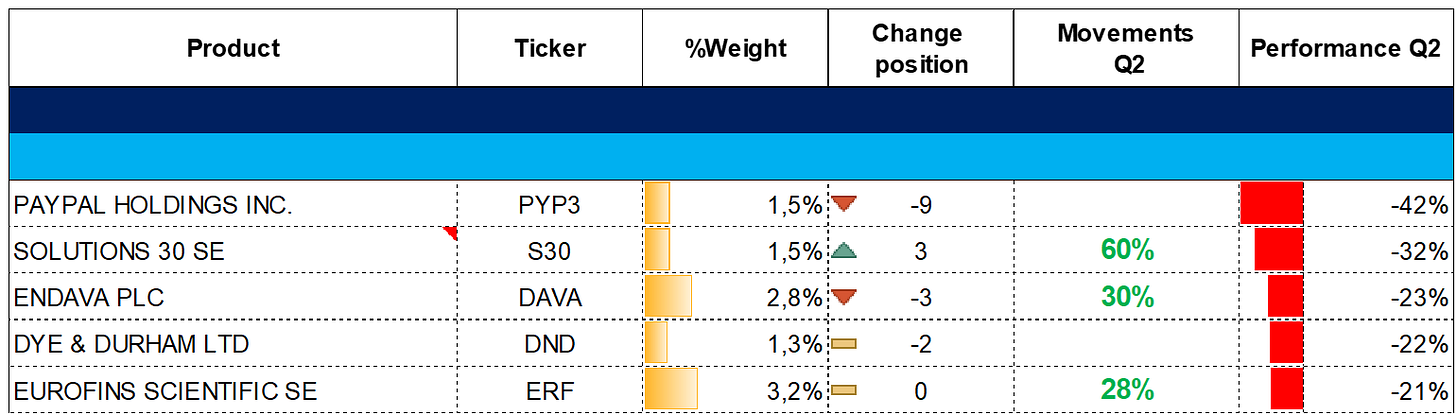

Worst Performers:

A few positions have underperformed this quarter:

Paypal $3PYP: This is actually the Paypal Levshares 3X ETP, which is extremely volatile. Paypal itself was down “only” 11%.

Solutions 30 $S30: Despite good results, the stock was hit hard by the expulsion from the SBF120 index and the overall downturn in the French market.

Endava $DAVA: No significant news.

Dye & Durham $DND: Extremely volatile, recently targeted by activist investor Engine Capital, which holds about 6% of the company. They are pushing for better capital allocation and board inclusion. However, DND's response was very disappointing. This topic could fill a book.

Eurofins $ERF: Targeted by a short report from Muddy Waters.

Portfolio

Here's how my portfolio was allocated as of June 30, 2024:

Thank you for taking the time to read through my Q2 2024 portfolio update. I value your interest in my investment journey. If you have questions or need more insights, don't hesitate to reach out. Until next time!

Warm regards,

Guybrush

please stay away from stuff like pyp3, highly toxic stuff, might as well set your money on fire directly.....