2024/03: Watchlist Updates and Recent Moves

Information Services Corporation $ISV, Solutions 30 $S30, Bastide $BLC, Titanium Transportation Group $TTNM and STMicroelectronics $STM

Hi everyone,

In this March update, I'm diving into the latest from several companies, including Information Services Corporation $ISV, Solutions 30 $S30, Bastide $BLC, Titanium Transportation Group $TTNM and STMicroelectronics $STM. I'll also share my recent investment adjustments and update my watchlist with price targets at the end.

PORTFOLIO ADJUSTMENTS

Increased investment in: Bastide $BLC, Teleperformance $TEP

Sold: none

New Positions: none

SIGNIFICANT DEVELOPMENTS

Information Service Corporation $ISV

Information Service Corporation ($ISV) released its annual report, with results aligning with previously communicated expectations. I've detailed these outcomes in past updates, so I'll briefly touch on a significant highlight from the Management’s Discussion and Analysis:

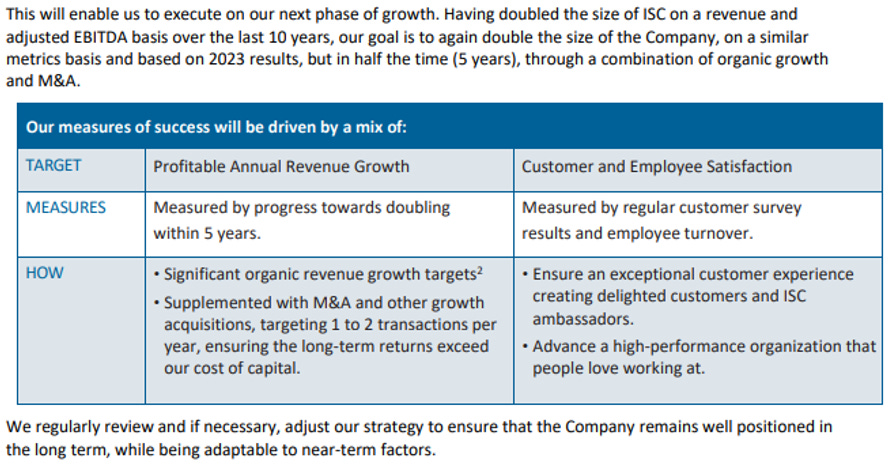

The company has set a bold new business goal:

[…Having doubled the size of ISC on a revenue and adjusted EBITDA basis over the last 10 years, our goal is to again double the company's size, on a similar metrics basis and based on 2023 results, but in half the time (5 years), through a combination of organic growth and M&A…]

This ambition points to an anticipated annual growth rate exceeding 15%.

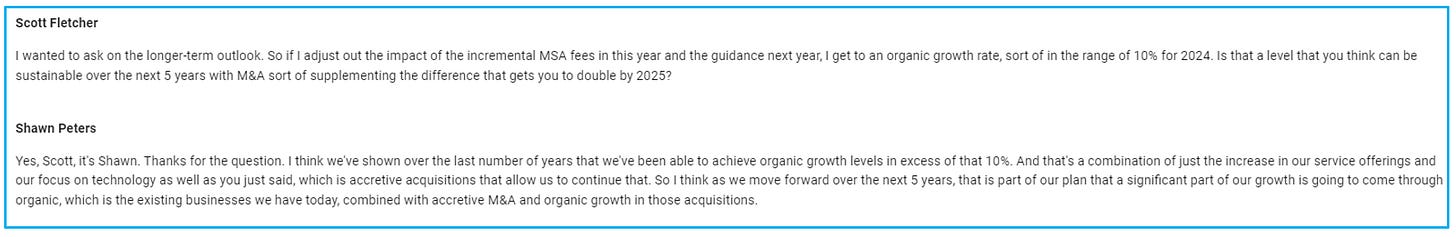

During the earnings call, analysts probed about the feasibility of this growth, to which management affirmed that a 10% organic growth rate over the next five years is both realistic and attainable, with strategic acquisitions complementing this expansion. The Services segment, in particular, is identified as a critical driver for organic growth.

Solutions 30 $S30

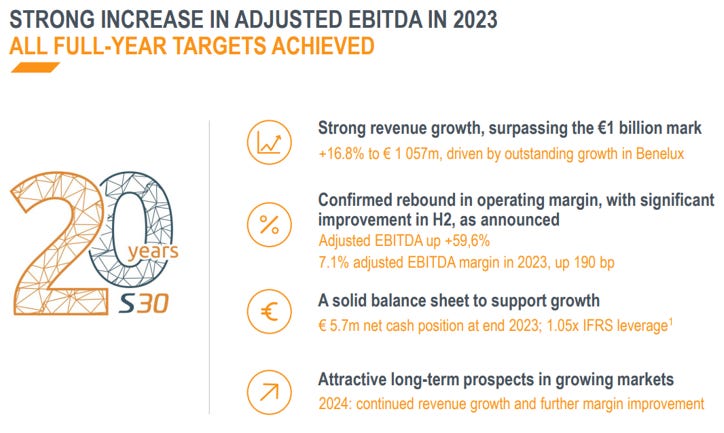

Solutions 30 published their annual report, and as hinted in their January preview, their results have been exceptional, breaking the 1 billion euro revenue mark for the first time and achieving a significant margin recovery.

To recap, before the pandemic, the company enjoyed over 20% annual revenue growth with a stable EBITDA margin of around 10%, without share dilution. Yet, 2022 ushered in a 'perfect storm'. In France, their largest market, core services like fiber and smart meters deployment matured, leading to revenue decline amidst rising costs in an inflationary environment, strongly impacting their margins. However, the company also managed to capitalize on competitors' bankruptcies to acquire parts of their operations. Meanwhile, investments were made to expand fiber deployment in Belgium, anticipating future gains.

2023 marked a turnaround year. The French market stabilized, transitioning fiber and smart meter services from deployment to maintenance, with energy (particularly photovoltaics) emerging as a new growth driver. EBITDA margin rebounded from 1% in H2 2022 to 9.6% in H2 2023. Now, over 60% of their revenue comes from outside France, driven by a 72% growth in the Benelux region and an 11.4% EBITDA margin.

For 2024, they anticipate less growth in Benelux due to the elections, and expect expansion to surge in "other countries" currently representing ~25% of revenue (like Poland, the UK, and Germany) where recent investments and contracts are set to boost their contribution and improve margins (already up to 4.8% in H2).

Looking ahead to 2024, Solutions 30 is set for further expansion but prefers to remain prudent and hasn’t pinned down specific growth figures. They do, however, target an EBITDA margin of 10%-15%. Gianbeppi Fortis, the CEO, stands by the ambitious mid-term aim of hitting 2.5 billion euros in revenue without resorting to share dilution. He specified in the conference call (as highlighted by an analyst's query) that this growth is envisioned within a 4-6 year timeframe, which implies a revenue CAGR exceeding 20%.

The reception to the outlook led to a few analysts lowering their target prices the following day. In my analysis, I've chosen a conservative path, estimating 8-10% annual growth, a more cautious forecast compared to the company’s own ambitious targets. Despite this, I am optimistic about Solutions 30's capacity to return to its historical 10-15% EBITDA margin, even with the moderated growth assumption in my model. Given the past issues with the audit and approval of their report, I am particularly keen on awaiting the audit and approval of this year's report, along with insights from the investors' day in May, before making any decisions.

Bastide $BLC

Bastide released their H1 results through a press statement and published their Half-Yearly Financial Report a few days later. The stock plunged after the press release and slightly recovered after the publication of their report. Here are my takes:

Revenue growth and operating margins met the guidance, which is good. The unwelcome surprise, however, was the significant increase in their cost of debt, alongside their inability to reduce debt during the last semester, even after selling a couple of assets.

The debt cost escalated to 7% from under 5% last year. While further rate hikes seem unlikely, this level of leverage could put them at the mercy of creditors' goodwill.

Can Bastide default on its interest payments?

I have followed some discussions on Twitter and Boursorama forums and noticed some confusion regarding Bastide's free cash flows. The company reports strong organic growth and hefty CAPEX, which traditionally paints a picture of low free cash flow (FCF). However, a closer look reveals that much of this CAPEX is invested in purchasing new equipment for leasing, rather than simply refreshing stores. This strategy essentially works on a financial spread: borrowing at a lower rate to acquire assets that are leased out at a higher rate. When this leasing strategy is factored in, Bastide is expected to generate over 50 million euros in FCF in 2024, underpinning its impressive organic growth.

If the cost of debt remains at those high levels, they should be able to manage without major problems. But further increases could spell trouble: despite Bastide's leading position in its niche, their pricing flexibility is strongly limited due to sector regulation.

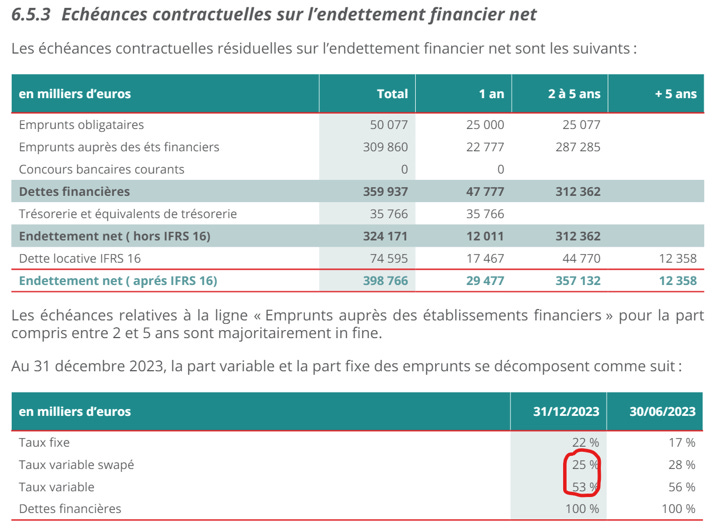

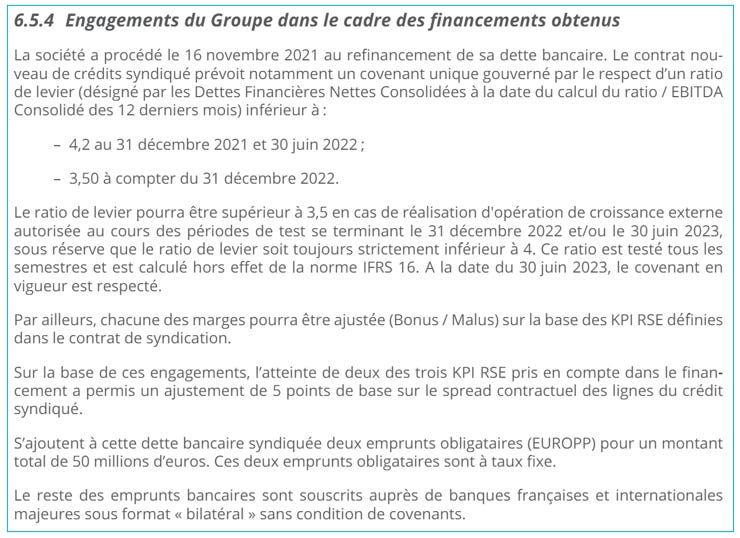

I include a couple of fragments from their financial report:

This indicates that if the 3-month Euribor rate were to increase by 100 basis points (1 percentage point), it would negatively impact the group's debt cost by €1.9 million, which is manageable.

This indicates that the last credit agreement outlines a financial covenant to maintain a leverage ratio (net consolidated financial debts to consolidated EBITDA over the last 12 months) within specific limits: 4.2 until June 30, 2022, and 3.5 from December 31, 2022. Nonetheless, there's room for maneuver in terms of external growth activities; the ratio can surpass 3.5 during test periods ending on December 31, 2022, and/or June 30, 2023, provided it stays below 4. This clause is designed to facilitate significant acquisitions or investments that could temporarily elevate the leverage ratio.

To conclude, Bastide's strict compliance with these financial covenants, combined with the agreement's allowance for growth initiatives, confirms that the current leverage ratios are within the limits sanctioned by the banks. This adherence highlights Bastide's financial prudence and strategic planning in balancing debt management with expansion efforts.

However, despite not foreseeing any challenges in meeting interest obligations, I acknowledge a potential liquidity risk arising from the prevailing credit environment, which could curtail the company's ambitious growth plans.

I've refined my model to reflect the increased debt cost and potential uncertainties. The stock is likely to remain under pressure until we see rate cuts and the next financial report.

For those interested in Bastide, I recommend checking out Olivier's analysis from Emerging Value. I fully concur with his assessment.

From my side, as mentioned above, I made a couple of purchases during the month, at 15.00€ and 14.06€.

Titanium Transportation Group $TTNM

Titanium Transportation Group $TTNM published their Q4 and FY 2023 results, with revenue in line with guidance and an EBITDA margin 1.3% above expectations. The company frequently revises its revenue guidance every quarter, largely due to its sensitivity to fuel costs which significantly impact transportation costs. Despite these quarterly adjustments and the volatile nature of the truck transportation market, the key takeaway is their consistent ability to maintain margins and increase both transportation and trading volumes. And this was achieved while making some opportunistic acquisitions and maintaining a healthy balance sheet.

I've extensively discussed this company in recent months, so I will not dwell further. They've provided an initial outlook for 2024, though it's very likely the company will continue updating it throughout the year—projecting 12%-16% revenue growth with the same level of EBITDA margin. This valuation positions the company at an attractive 4-5x EV/EBITDA for 2024.

During the conference call, they also outlined expectations for CAPEX to remain low for the next two years, thanks to last year's significant fleet renewal (10m expected in 2024 vs 29m in 2023). This strategic move is expected to enhance their free cash flow (FCF) and support growth initiatives.

As a reminder, the company has set an ambitious goal to reach 1 billion in revenue by 2028, implying a CAGR of 18%. In my analysis, I adopted a more conservative stance, anticipating an annual growth rate of about 10% while maintaining current margins and their high level of debt.

STMicroelectronics $STM

Released their Q4 and full-year report, aligning with previous guidance. They've also shared expectations for Q1 and the full year of 2024, predicting a 6% decline in sales and a gross margin reduction from 47% to the low to mid-40s. During the conference call, they clarified that this forecast is driven by inventory adjustments, not pricing issues. Their mid-term goals for 2025-27—to surpass 20 billion euros in sales with gross margins around 50%—stand firm.

I've updated my model to account for these projections, taking a conservative stance. I anticipate they'll only reach their sales targets by 2028 and achieve their margin goals partially.

Newlat Food ($NWL) and Kontron ($KTN) have both released their annual reports. Upon initial review, Kontron's results appear in line with guidance, and its acquisition process seems to be progressing smoothly. Newlat Food, however, experienced a challenging fourth quarter. I plan to delve deeper into these reports and possibly provide more detailed insights next month.

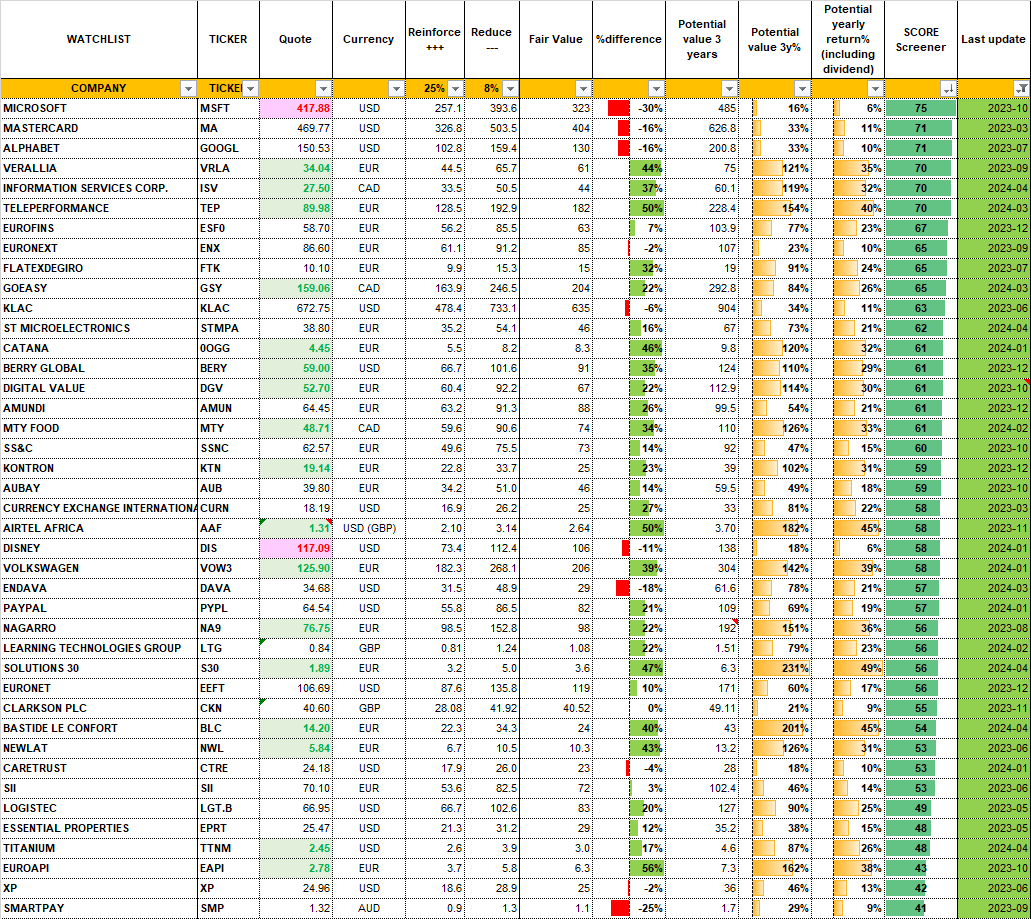

WATCHLIST UPDATE

And as always, I anchor this post with an update on my Watchlist.

Thank you for taking the time to navigate through this update. I treasure your feedback as it sharpens our investment compass. Eager to hear your thoughts and dive into fruitful discussions. Stay tuned—I'll share a portfolio update before the month closes.

Guybrush