2024/10: Watchlist Updates and Recent Moves

MTY Food Group $MTY, STEF SA $STF, Digital Value $DGV, Sesa Spa $SES

Ahoy, mates!

Here’s my latest update covering recent portfolio moves, new watchlist highlights, and key developments that have caught my eye.

Index:

Portfolio Overview & Adjustments

Increased Investments

Reduced Investments

New Positions

Sold Positions

Options Strategy

Significant Developments

Watchlist

PORTFOLIO OVERVIEW & ADJUSTMENTS

For the month, my portfolio stayed mostly flat, ending slightly in the red. Most holdings held steady, with one major exception: Digital Value ($DGV), which dropped 80%, taking a 2% hit on my overall portfolio. I’ll dig into the details on that one further down.

NEW POSITIONS:

STEF SA ($STF)

This month, I initiated a position in STEF SA at €131, at an LTM price-to-earnings ratio (PER) of 9x. STEF is a French leader in temperature-controlled logistics, with over a century of experience. Specializing in managing the cold chain, STEF ensures safe storage, handling, and transportation of perishable goods—primarily food—across Europe. Here’s why STEF stood out as a compelling addition:

Essential Infrastructure with Consistent Demand: STEF serves primarily the food industry, a sector with stable, essential demand, making it more resilient during economic downturns. The company’s extensive real estate holdings, including 283 cold storage facilities, anchor its role in Europe’s food supply chain.

Dominant Market Presence and Network Effects: As a leader in temperature-controlled logistics across France, Italy, Spain, and Portugal, STEF benefits from network effects that drive efficiency and cost-effectiveness. Its established infrastructure also positions it well for growth in high-demand areas like fast food logistics.

Consistent Financial Strength and Strategic Focus: STEF shows strong financial resilience with steady growth, high ROE, expanding margins, and prudent debt management, even through various crises. Their recent divestment of the maritime segment allows for a streamlined focus on core food logistics, enhancing profitability.

Aligned Leadership with High Insider Ownership: CEO Stanislas Lemor, along with the Lemor family (who led STEF’s 1987 buyout) and employees, hold over 70% of STEF’s shares, aligning management closely with shareholders and supporting the company’s long-term commitment to sustainable growth.

Sustainability Initiatives: STEF prioritizes sustainability through “Blue Enerfreeze,” its green energy division, and proprietary software that optimizes logistics efficiency. These investments aim to lower environmental impact and operating costs while strengthening the cold-chain network.

Long-Term Growth Outlook: STEF’s growth prospects are strong, fueled by organic expansion and acquisitions in a fragmented European market. Its vital infrastructure role should support further valuation growth as market recognition of STEF’s essential services increases.

Why the Opportunity Exists: STEF’s unique position, blending logistics and infrastructure, might leave some investors unsure of its value, resulting in a discounted valuation. I view this as an opportune entry point for a quality company with a defensive business model and stable revenue streams.

This new position aligns with my strategy of investing in high-quality companies with defensible market positions. I’ll be closely watching their international expansion efforts and client acquisitions to see how they further leverage their infrastructure for growth.

Credit where it’s due: This idea came from Louis de Fels, General Manager of Gay-Lussac Gestion (Twitter link / YouTube Interview), and a comprehensive deep dive published by the blog Value and Opportunity, which provided valuable information on STEF’s unique strengths.

Eli Lilly $LLY

I won’t go into much depth on Eli Lilly, as it's already extensively covered by analysts, and my blog usually focuses on smaller, lesser-known companies. I entered around $780 during the dip following their latest earnings release, which briefly dropped the stock nearly 15%.

There’s a solid product-driven catalyst: Eli Lilly’s new diabetes and obesity drug, Mounjaro (tirzepatide), has now FDA approval for both diabetes and obesity. This dual approval sets it up to capture a massive market, especially with the surging demand for obesity treatments. Novo Nordisk’s Ozempic and Wegovy have already proven how strong this market is, and Mounjaro has strong potential to boost Lilly’s revenue for years to come.

On a personal note, my sister (an endocrinologist) has been urging me to invest in Lilly—especially after I ignored her advice on Novo Nordisk a few years back! So I’m finally in, though only with a small position, as this is a bit outside my usual circle of competence.

Learning Technologies Group $LTG

Don’t worry, I haven’t turned into a trader! If you’ve been following my updates, you know I sold my position in $LTG one month ago, right after the takeover bid was announced. This month, $LTG has been relatively volatile, trading well below the offer price—between 90 and 94 pence, and even dipping below 88 at times, versus the 100-pence offer. I also noticed some of the main shareholders were actively buying and selling on the same day.

With the deadline to submit the offer set for October 25, I decided to re-enter the position the day before at around 91-92 pence. However, on the 25th, they announced an extension for the offer by one month. I placed a sell order a few pence higher, which was executed the next day.

I believe $LTG is worth significantly more than 100 pence. There’s a strong chance that General Atlantic could raise their bid to 110 or even 120 pence, which would likely partially satisfy most shareholders. That said, there’s still a possibility they’ll withdraw the offer, which could send the stock down to 70 pence again. However, given the regulatory issues announced over the summer in the U.S., it makes sense that a U.S.-based firm would be interested in taking ownership sooner than later.

SOLD POSITIONS:

Digital Value $DGV

In early October, Digital Value faced intense scrutiny as Italian authorities launched an investigation into the company’s CEO, Massimo Rossi, over alleged corruption related to public procurement contracts. As part of the probe, Italian tax police reportedly searched the offices of Digital Value and other firms. The investigation centers on alleged bribes to officials at Italy’s state-owned IT company, SOGEI, intended to secure lucrative public contracts. This news hit Digital Value particularly hard, as public sector contracts account for over a third of its revenue.

Following the announcement, Digital Value’s stock took a sharp hit. Trading was briefly suspended after an initial 10% drop, only to plummet by as much as 80% when trading resumed. In response, the company launched its own internal investigation and quickly restructured leadership by separating the CEO and Chairman roles, both previously held by Rossi (who is also the main shareholder!), and assigning these roles to other executives to steady operations.

The next few months are critical. Even if Digital Value is legally cleared, the reputational damage could impact its ability to secure future public contracts. On the other hand, if deeper issues come to light, the company may face operational disruptions, potential contract cancellations, and financial penalties.

For now, Digital Value has been releasing limited weekly updates, all in Italian, which has left international investors with little insight and no conference calls or English reports to clarify the situation. The most recent update announced a temporary suspension of its planned acquisition of Italtel S.p.A., a key component of its growth strategy.

At first, I thought I’d let this position sit and ride out the storm—after all, with an 80% drop, it was down to just 0.2% of my portfolio. But with the ongoing lack of transparency and the seriousness of the situation, I decided to exit entirely and realize the losses.

INCREASE INVESTMENTS:

MTY Food Group $MTY

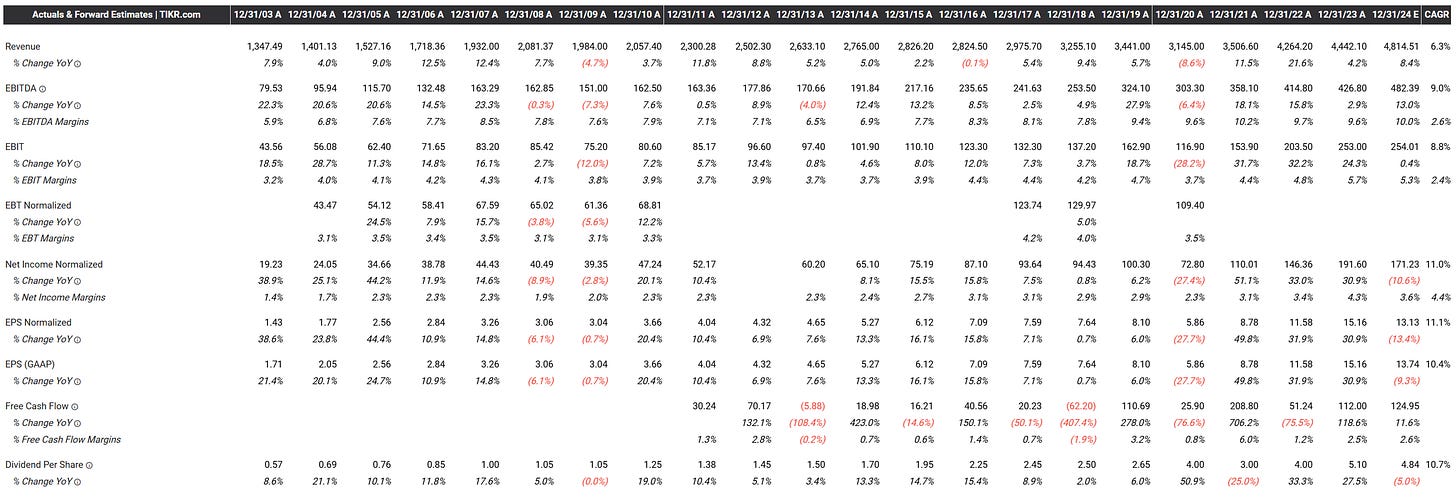

The stock is currently trading at a historically low valuation of 7x P/FCF—levels we haven’t seen since a few months in 2020 during COVID, which is when I first bought in (at around CAD 20). I haven’t discussed MTY in a while, so here’s a deeper dive into the company’s position and my reasons for adding to my stake.

For those unfamiliar, MTY Food Group is a Canadian restaurant franchisor and operator founded in 1979 by Stanley Ma. Known for its inorganic growth, MTY operates around 90 brands, largely through franchise agreements. MTY gained broader attention back in 2015 when Chris Mayer’s book 100-Baggers was published, as the success story of MTY Foods was featured in it. Link to case study of Chip Maloney.

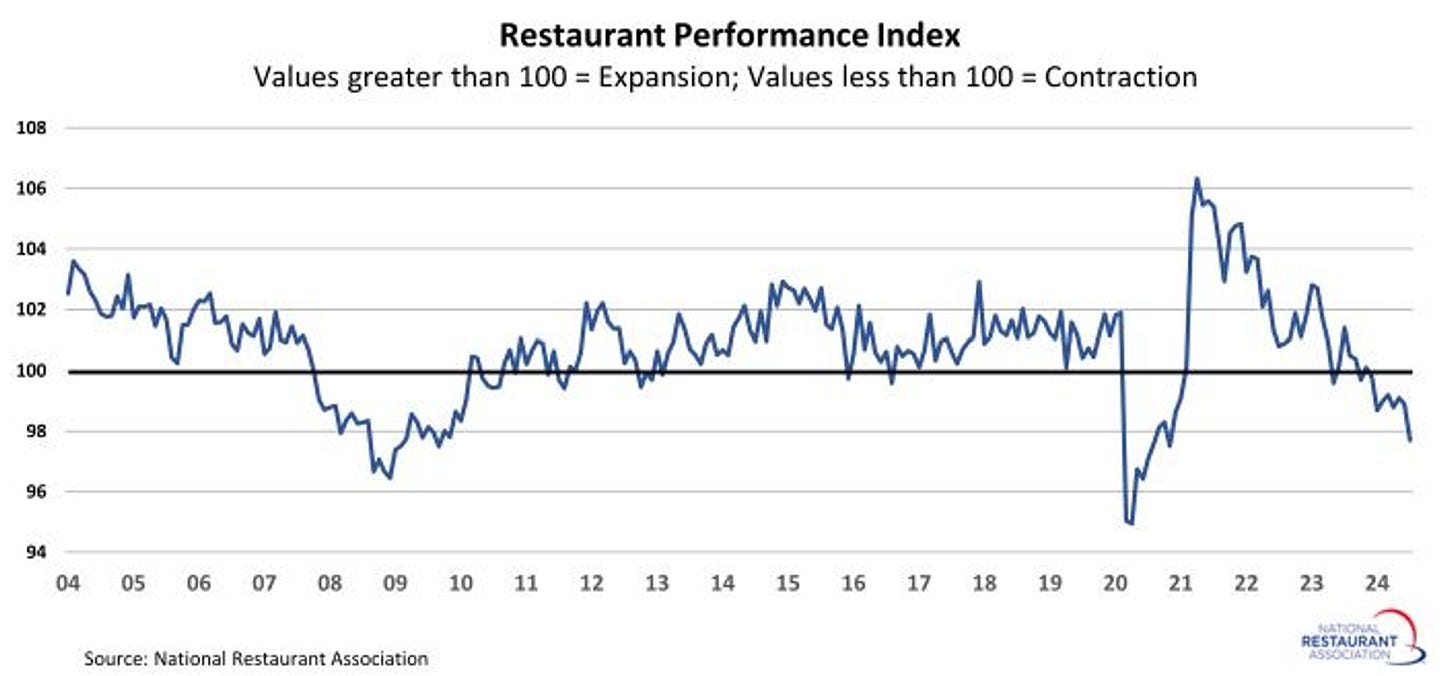

In recent years, MTY’s acquisitions have focused more on the U.S., with about two-thirds of its system sales now coming from that market. The management team is stable, with CEO Eric Lefebvre having 15 years in executive roles, and Stanley, who owns 13% of the company, adding significant skin in the game. The CFO, who leads MTY’s acquisitions, has also been actively involved. Yet, despite this, the stock is trading at a historically low valuation. Key factors include a slowdown in acquisitions, higher leverage, and investor concerns about rising corporate store revenue and weaker consumer demand in North America. Critics argue that MTY may struggle to replicate its Canadian growth in the U.S., with high interest rates and inflation weighing on restaurant demand.

Why Is MTY Trading “Cheap”?

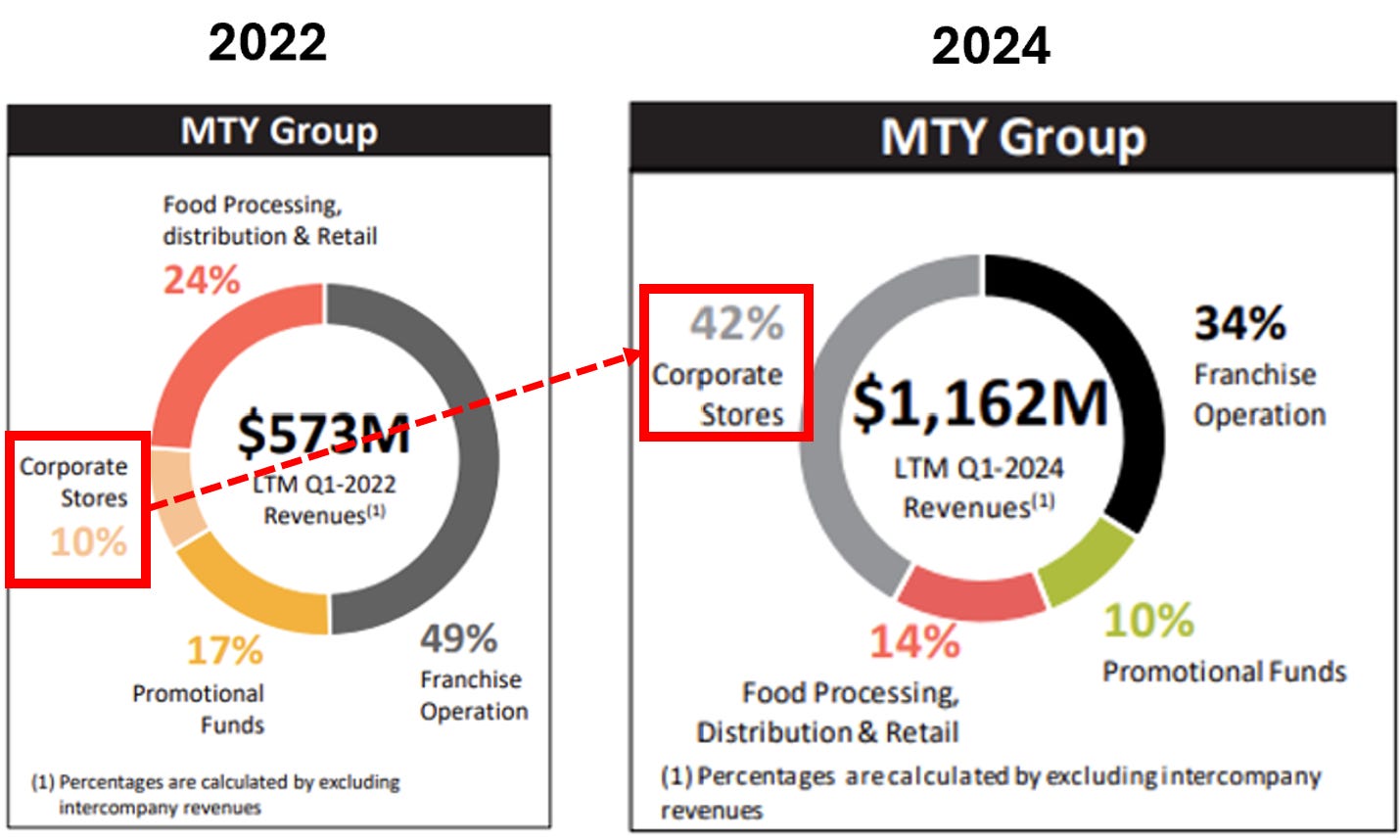

At first glance, MTY’s top-line revenue has grown significantly, but there’s a sense the business model has weakened. Over the last decade, revenue has increased tenfold, but margins have declined. EBITDA margins, for example, have dropped from 40% to 20%, while net margins have fallen from 25% to 8%. The shift in revenue composition also stands out, with corporate-owned sales now representing a larger portion (42% vs. 34% for franchise operations, while some years back was 10% vs. 50%).

This shift is primarily due to recent acquisitions like Barbecue Holdings and Wetzel’s Pretzels, which included a number of corporate-owned locations. While corporate stores now represent a higher percentage of revenue, they account for only about 3% of MTY’s total locations (around 220 out of 7,100 stores), and their impact on FCF remains limited. Despite the lower EBITDA margin from corporate stores, MTY’s FCF conversion rate is still high—around 80% of EBITDA—as the franchise model remains the backbone of their cash flow. Notably, franchise margins are not only stable but have actually improved, with recent reports showing margins well above 50%.

Franchise Model Remains Core

MTY is not moving away from its franchise-heavy model. The recent increase in corporate store revenue is largely due to acquisitions, not a strategic shift. In fact, the CEO has reiterated the company’s commitment to franchising, with plans to selectively divest corporate stores without drastically changing the portfolio. Management has been clear that franchising is still at the heart of MTY’s strategy, and they continue to focus on supporting franchisees and improving existing locations. Here are a few supporting quotes:

FY2023 Conference Call (2024-02-15):

“The impact of these transactions delivered revenue growth for corporate restaurants and franchise operations of 50% and 18%, respectively, in the U.S. and International segment.”

“The 79% conversion rate of EBITDA into free cash flow is sequentially better than in recent quarters and is reflective of our efforts to maximize cash flows and optimize our asset-light model.”

Q2 2024 Earnings Call, Jul 11, 2024:

Eric Lefebvre emphasizes MTY's strong franchise focus: "We're still a franchisor at heart, and that's important for us."

He also mentions plans to sell corporate stores in the near future, but without making any large shifts:

"We will have a few corporate stores being sold in Q3. We don't want to... shift the portfolio dramatically."

"We will sell some corporate stores. We'll be opportunistic about that. So we will see a few sales in Q3, probably in Q4 as well."

Investment Thesis and Catalysts

From my perspective, MTY remains a strong investment at current levels. With a solid entry point around CAD 40-45, the valuation is appealing at an historical low of 7x P/FCF. While MTY may not grow as rapidly as it did in the past, it’s still relatively small in a fragmented market, leaving room for growth through disciplined acquisitions.

Key catalysts include:

Interest Rate Reductions: Lower rates would boost FCF and reduce the cost of debt.

Rebound in Restaurant Demand: As consumer spending normalizes, revenue growth could pick up.

Corporate Store Divestitures: Selling corporate-owned stores would lower revenue but free up cash and improve margins, further supporting FCF.

Expansion Potential: With cash from divestitures, MTY could fund new acquisitions and maintain its asset-light model.

In short, rather than focusing on traditional margin metrics—which might suggest the business is deteriorating—MTY’s emphasis on free cash flow gives a more accurate picture of its strength. While revenue is growing significantly, the recent shift in revenue mix toward corporate stores has temporarily compressed margins, potentially giving the wrong impression. In reality, MTY is still generating strong cash flows thanks to its franchise-heavy model, and its FCF conversion rate remains robust. With plans to gradually reduce corporate stores, margins should improve over time.

Options Strategy

My sold PUTs on Teleperformance ($TEP) expired unexercised, adding 0.3% to my portfolio (annualized 3.6%).

This month, I sold some PUTs expiring in one month on Eurofins ($ERF) at €46-48 and Sesa SpA ($SES) at €80-82. If these options expire unexercised, the premiums will add about 0.25% (annualized 3%) to my portfolio. If exercised, I’ll be glad to add both stocks to my holdings.

Sesa SpA isn’t currently in my portfolio or watchlist, but I’ll be adding it soon (at least to the Watchlist :D).

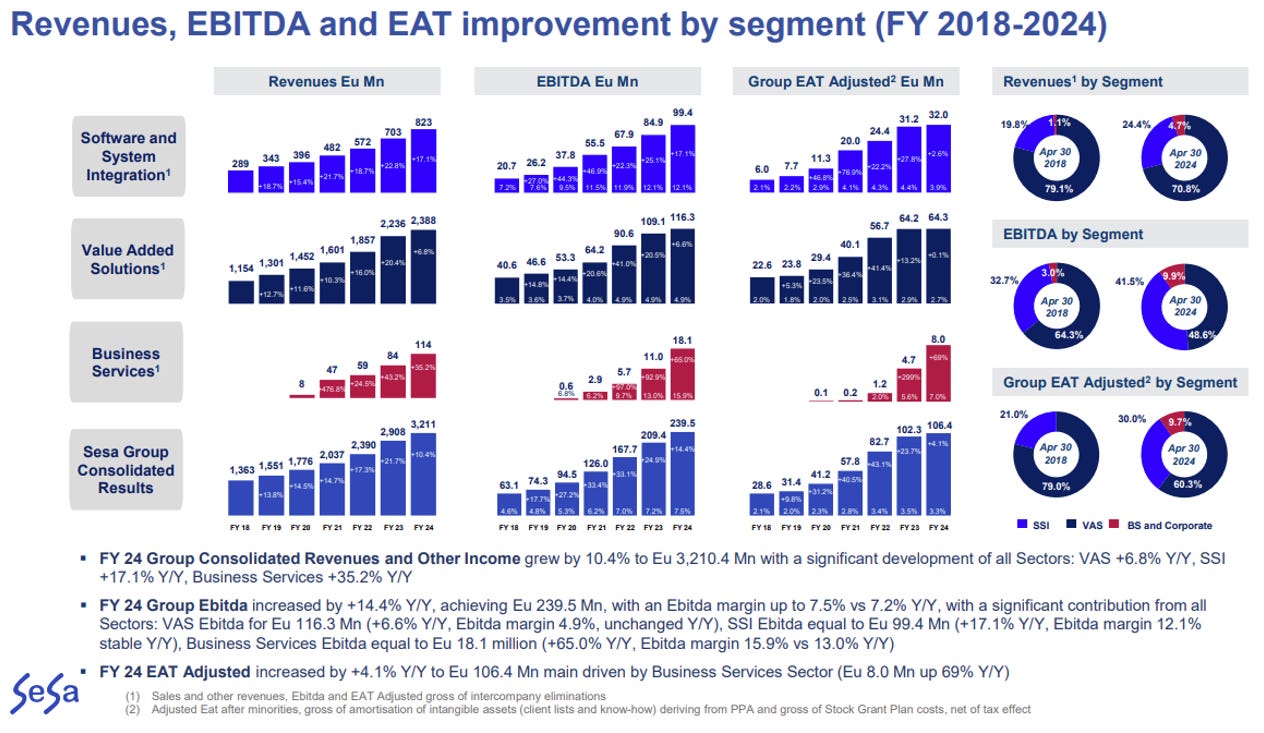

This company is Italy’s market leader in IT hardware distribution, holding around 50% market share. While it started as a distributor, it has since expanded into three segments, adding more balance to the business:

Computer Gross (VAS): The distribution arm brings in €2.4 billion annually, with about 5% growth and a 5% EBITDA margin—pretty high for a distribution business. It’s nearly half the Italian market, way ahead of competitors like Tech Data (Synnex), which Warren Buffett actually bid on but missed out on buying for $5 billion at PE 15x YouTube Link.

VAR Group (Software & System Integration): This division generates €800 million in sales, growing at 20% with a 12% EBITDA margin. It focuses on IT engineering services, tapping into the rising demand for digital transformation across Italy.

Base Digitale Group (Business Services): Although smaller at €120 million in revenue, it’s the fastest-growing segment, with 30% growth and a 15% EBITDA margin. This arm provides digital services for financial firms, a high-margin, high-demand space.

When you first look at Computer Gross, it might not seem exciting, given its low margins, as with most typical distribution businesses. But there’s more under the surface. The distribution sector is essential in industries with many suppliers and small clients, acting as a bridge by managing warehousing, inventory, and logistics. This means Computer Gross plays a critical role as the single point of contact for both sides.

Despite its appearance as a low-margin operation, it’s actually a spread-based model similar to banking, where the bulk of costs are variable and directly tied to sales volume. This setup allows for stability and scalability despite tight headline margins. By stripping out variable costs and looking at free cash flow versus EBITDA, the FCF conversion rate exceeds 40-60%. This high FCF conversion rate offers a more accurate picture of the company’s efficiency and cash generation.

Currently, the stock is trading at a historical low valuation, much like other small caps in Europe. As an Italian company, it took an additional hit after the Digital Value scandal, though it isn’t involved. Altogether, Sesa presents an opportunity to acquire a leading player in Italian IT at a discount, combining stable revenue with strong growth potential.

SIGNIFICANT DEVELOPMENTS

I’ll keep this brief since the post is already running long.

Smart Pay $SMP.AX: This Australia and New Zealand-based payment processing stock saw sharp declines (over 40%) after the Australian government announced plans to ban debit card surcharges by 2026—a regulation the EU implemented years ago. It wasn’t in my portfolio, but I’d been following it. Given the increased uncertainty and risk, I’ve decided to remove it from the watchlist. Smart Pay had been growing quickly by charging 0 fees directly to its primary customers—retail shops—that pass these fees on to their own customers at checkout. This potential regulation could seriously impact Smart Pay’s business model.

Nagarro $NA9: Revised down their 2024 guidance and announced they’re in talks regarding a potential public tender offer.

Flatex Degiro $FTK: Reported strong results and announced that revenue is expected to come in slightly above guidance (+15%).

Dye & Durham $DND: Announced they’re exploring a sale after receiving takeover interest.

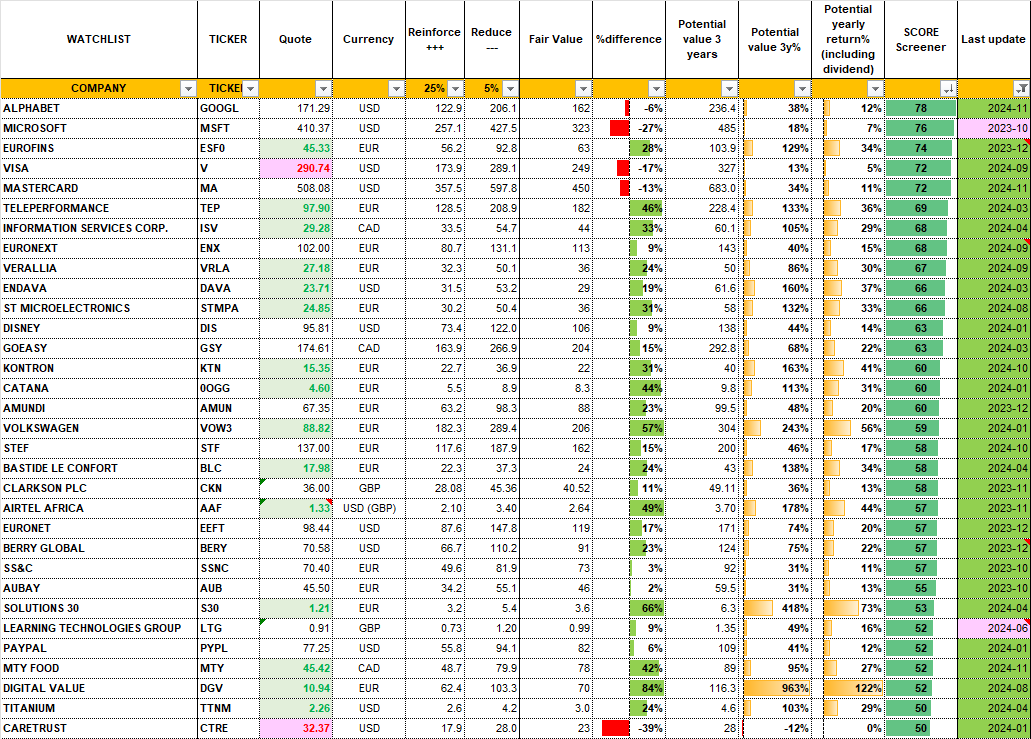

WATCHLIST UPDATE

And as always, I anchor this post with an update on my Watchlist.

Thanks for reading this update! I value your feedback and look forward to hearing your thoughts and diving into some good discussions.

Safe waters,

Guybrush