Hi all,

After Teleperformance's stock dropped again following their FY 2023 results, I wanted to share my thoughts on the results, the company's current situation, and my recent actions.

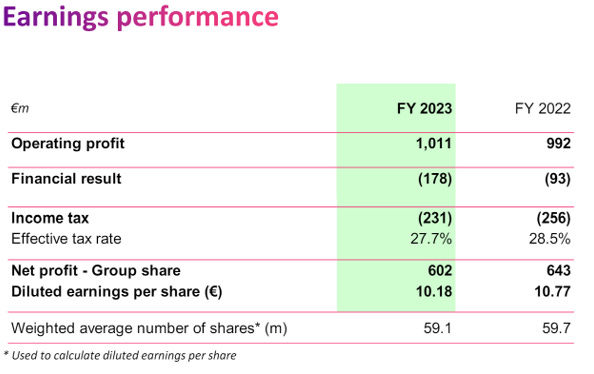

1 FY2023 Results

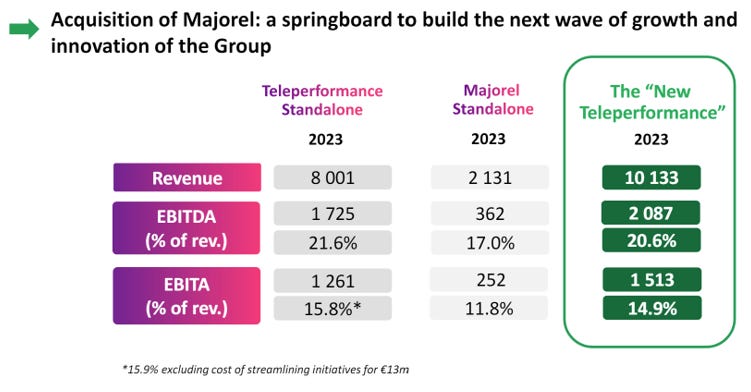

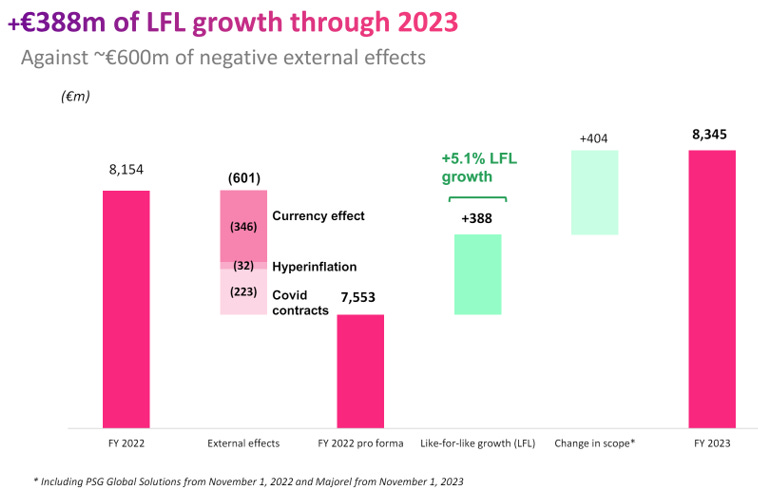

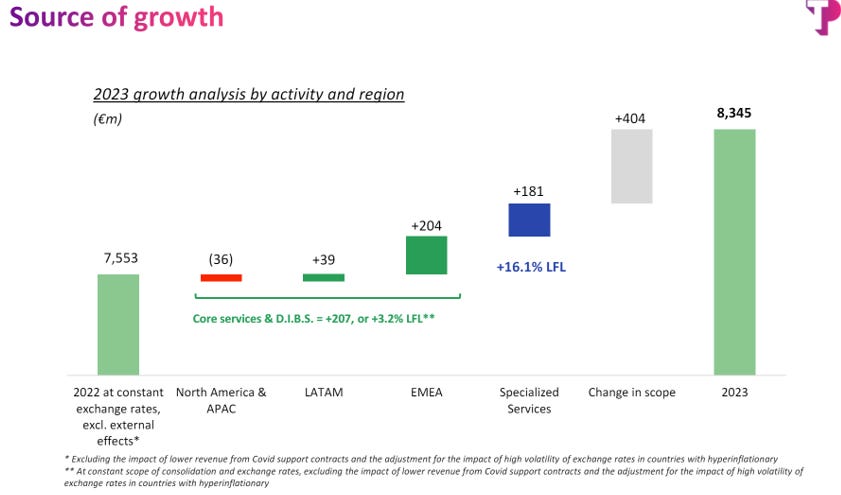

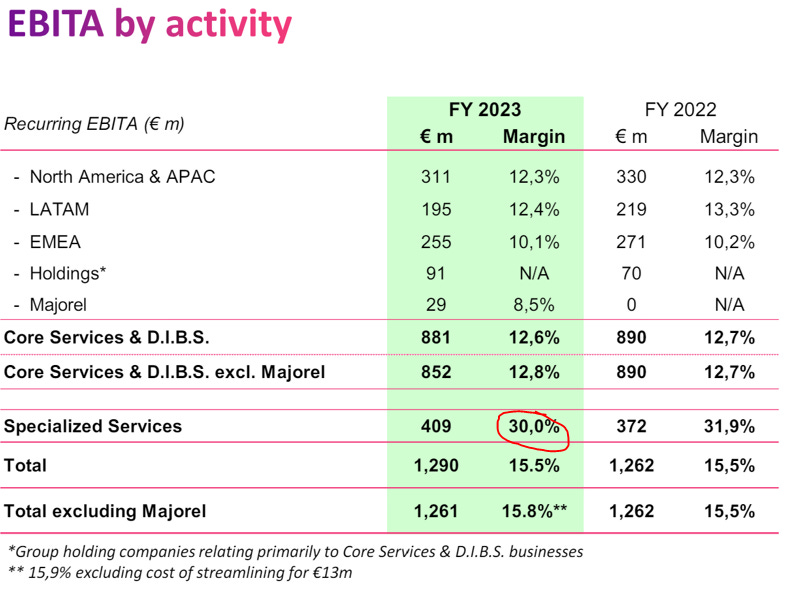

Teleperformance announced revenues of €8.345 billion, a 2.3% increase from 2022. Without the Majorel acquisition, there would have been a 1.8% decrease. The EBITDA margin slightly fell to 21.3% from 21.5% last year. Excluding Majorel, it actually improved to 21.6%. Adjusting for COVID contracts and the impact from currency and inflation, particularly impacting some regions in 2023, they've reported a decent 5.1% increase in like-for-like revenue.

Growth drivers included:

Core services contributing €207 million (+3.2%)

Specialized services adding €181 million (+16.1%), notable for their higher margins (EBITA >30% versus 10-15% in core services)

Acquisitions (two months of Majorel + PSG Global Solutions) bringing in €404 million

Specialized services not only grew the fastest but also generated the highest margins (>30%).

Below are the specialized services, which have experienced robust growth over the last few years, with a CAGR of 15%-20%.

They’re betting big on India, expecting to double revenue there by 2027 (CAGR of 17%).

Net earnings were €602 million, down from €643 million in 2022, primarily due to increased financing costs from acquiring Majorel. Nonetheless, net FCF rose to €812 million from €703 million, driven by stringent cost control and reduced CAPEX.

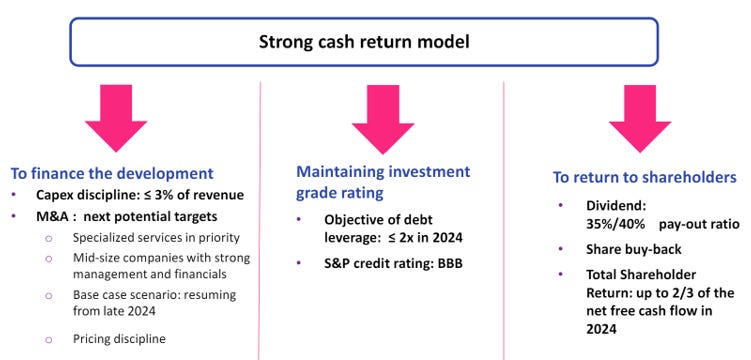

DEBT, FINANCIAL STRUCTURE AND CAPITAL ALLOCATION

Net debt, excluding leases, stands at a manageable €3.7 billion with an average cost of 3.3% and a maturity of 3.75 years. The acquisition of Majorel was financed with €2 billion in debt and about €1 billion in Teleperformance shares (priced at €217 each), increasing their debt to 2.18 times EBITDA.

In 2023, with more than €800 million in FCF, the majority was allocated to dividends (€227 million) and share repurchases (€366 million). Despite issuing 1 m€ in shares for Majorel, the aggressive share buyback program resulted in 1% fewer shares outstanding by year-end, indicating strong capital management.

2024 OUTLOOK AND CAPITAL ALLOCATION STRATEGY

The 2024 financial outlook is promising and focuses on rewarding shareholders:

Like-for-like revenue growth projected at 2%-4% (excluding Majorel).

A slight increase in EBITA margin (0.1-0.2%).

An increase in net FCF.

Targeting a 35%-40% dividend payout ratio.

Continuing share buybacks.

Allocating up to two-thirds of net FCF to dividends and buybacks.

Aiming to maintain their investment grade rating by reducing debt to less than 2 times EBITDA and preserving their BBB credit rating.

They plan disciplined CAPEX and M&A activities, holding off on acquisitions until late 2024.

They’re playing coy on mid-term guidance, just hinting they’ll outgrow the market.

Comparing this outlook with competitors, Teleperformance stands out. For instance, TTEC Holdings anticipates a revenue decline of -4% to -9%, and TaskUs expects no growth in 2024 alongside a decline in EBITDA margin.

2 The End of Teleperformance?

Not by a long shot. Despite two panic-driven sell-offs in a single week—triggered first by Klarna news and then FY2023 results—each plummeting the stock by 25%, and together, slashing its value by about 40%, AI isn’t the end for Teleperformance; it’s a boon. It’s about leveraging AI for cost savings and better customer service, not getting replaced by it. Teleperformance is not new to leveraging AI; its use of chatbots is just the beginning. With a focused strategy on AI, expect even greater efficiencies and service improvements.

Teleperformance believes AI can automate a big portion of their service volume in the next three years. This should cut costs, boost efficiency, and expand margins.

Klarna's recent announcement, while interesting, doesn't fundamentally alter the landscape. It underscores that tech-savvy companies can harness tools like ChatGPT to develop their customer service solutions. However, this raises a critical question: Should companies divert core business resources to develop in-house solutions that lie outside their primary domain? Teleperformance's specialization and expertise in customer service solutions provide a compelling argument against such diversions.

This ties into a broader industry movement towards software development outsourcing. Firms like Endava and Nagarro are thriving as businesses aim to concentrate on their core competencies, relying on external expertise for technological enhancements, including AI. Thus, AI is not reducing Teleperformance's client base but is set to expand it, ushering in new projects and opportunities for innovation in customer service.

The true measure of success in this evolving field will be who can deliver the highest quality product at the best price. Here, Teleperformance distinguishes itself as an industry leader, with a wide client base already benefiting from its services and an expansive market opportunity ahead, thanks to its proactive embrace of AI.

In essence, the emergence of AI is not a death knell but a dawn of growth and innovation for Teleperformance, ensuring its continued leadership in the customer service domain.

3 Adquisition of Majorel

Was the Majorel acquisition a value creator? In my book, yes. Teleperformance offered 30 euros per share, totaling a 3 billion euro deal. They paid a 16x P/E and 8x EV/EBITDA multiple. Payment was in cash and shares, with shareholders able to opt for Teleperformance shares at a swap rate, valuing TEP shares at 217€ each.

They've managed to balance issuing new shares with a hefty share buyback program, effectively avoiding dilution. With the acquisition funded and a significant bond issue oversubscribed, it's clear the bond market isn't sweating over Teleperformance's debt levels. Their current interest rates are at 3.27%, and they're poised to pare down debt in 2024, targeting a leverage ratio of less than 2x.

Expected synergies from Majorel could hit 150 million by 2025. Even with just two months of Majorel in the books for 2023, and despite a slight dip in earnings per share due to debt costs, merging the pro forma accounts of both companies could boost EPS above 15€ in 2024, up from 10-11€ range pre-acquisition.

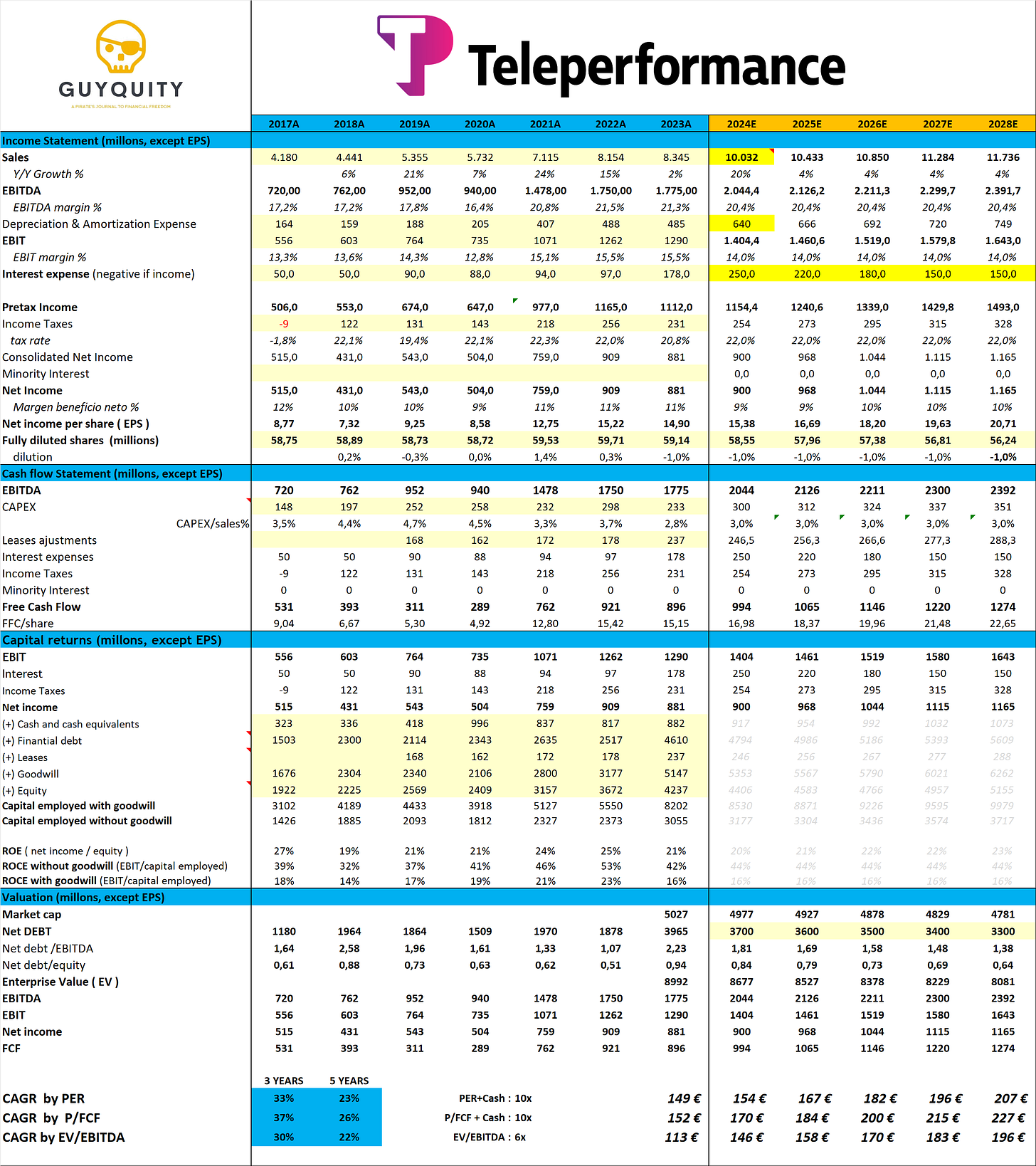

4 Valuation Model

I've delved into multiple scenarios for Teleperformance, spanning from highly optimistic to deeply pessimistic. Below, I'm sharing a moderate, conservative perspective that finds a middle ground:

Sales Outlook: Anticipating a minor dip in 2024 sales, slightly off from the company's 2-4% growth expectations. I expect a bounce back to 4% growth thereafter, spurred by organic initiatives and acquisitions.

Margin Forecast: Predicting a slight squeeze in EBITDA margins without immediate prospects for improvement.

Valuation Concerns: Given the potential for industry-wide disruptions, Teleperformance may face a period of lower valuation multiples, with P/FCF at 10x or EV/EBITDA at 6x considered.

Share Buybacks: Current stock prices could allow the company to significantly reduce its share count by more than 5% annually, though my model conservatively estimates only a 1% reduction.

This conservative view is just one piece of a broader analysis that also considers scenarios ranging from stagnation to decline in growth and more pronounced margin pressures. Remarkably, even under conditions where 2024 sees a 5% sales drop with no recovery and significant margin decline, the outlook remains positive.

If the table intrigues you or you're keen to craft your scenarios, don't hesitate to reach out.

5 My Moves Explained

In summary, the results are solid. Growth is slowing due to various factors, but the Majorel acquisition looks like a masterstroke. I'm not overly worried about disruption from generative AI; if anything, Teleperformance is well-positioned to lead the charge. Their sector still promises 6-10% growth in the coming years.

Given these dynamics, I almost doubled down on Teleperformance with February and March purchases, increasing my holdings by 80% between 84€ and 103€ (averaging around 94€). It now represents about 4% of my portfolio. Plus, I've dabbled in some call options.

Closing Thoughts

As we explore the world of investing, keep in mind that I'm just an individual investor sharing my experiences, not an expert. My thoughts on Teleperformance are part of a bigger picture and can change as the situation evolves. I encourage you to do your own research and make informed decisions. My views might shift over time, just like market conditions. I'm always open to hearing different perspectives and learning from them.

Looking forward to our next update. Until then, I wish you steady growth and smooth sailing in your investment endeavors.

Guybrush