2024/01: Watchlist Updates and Recent Moves

Bastide $BLC, Kontron $KTN.de, Digital Value $DGV, Information Services Corporation $ISV, Learning Technology Group $LTG and Solutions 30 $S30

Hi everyone,

In this January update, I'm diving into the latest from several companies, including Kontron $KTN.de, Digital Value $DGV, Information Services Corporation $ISV, Learning Technology Group $LTG, and Solutions 30 $S30. I'll also share my recent investment adjustments and update my watchlist with price targets at the end.

RECENT MOVES:

Increased investment in: Teleperformance $TEP, Eurofins $ERF

Sold: EuroApi $EAPI

New Positions: Bastide Le Confort Medical $BLC

After significantly increasing my position in EuroApi during November and December, I trimmed my holdings once Lonza's results pushed the price above €6.5, selling down to my pre-increase levels. However, as it remained a minor position, I chose to exit entirely, though I will continue to monitor it closely.

Why I Sold $EAPI: The decision to sell EuroApi was driven by several factors: despite its low valuation compared to peers, high-value assets, and CDMO services growing at 20% since its spin-off from Sanofi, the withdrawal of its mid-term targets, the departure of its CEO, and the absence of a new strategy raised significant concerns. The bear case is also compelling: lack of competitive edge against Indian and Chinese firms or Swiss counterparts, compromised high CAPEX levels, an inability to boost margins, and negative free cash flow.

Bastide Le Confort $BLC

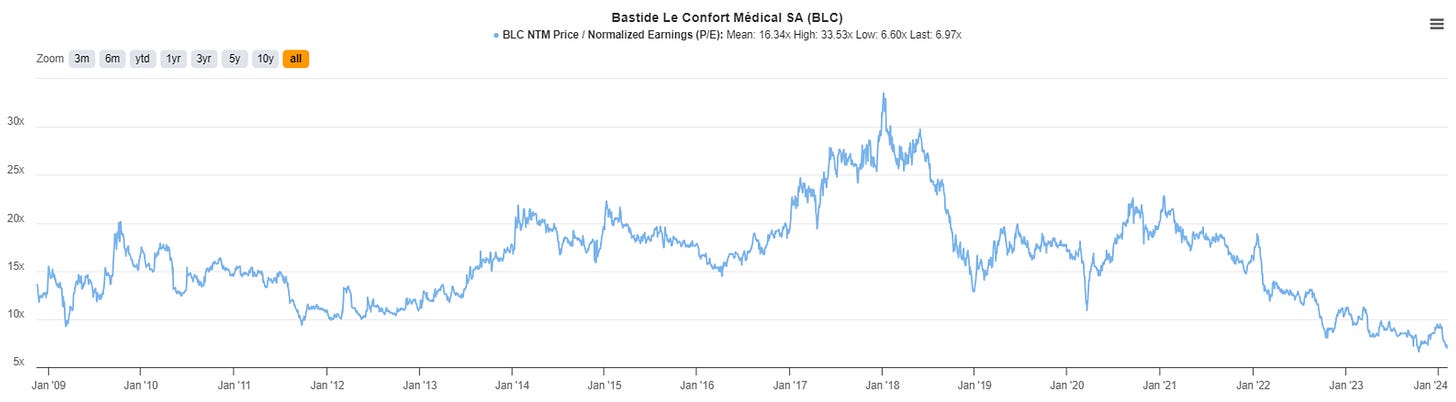

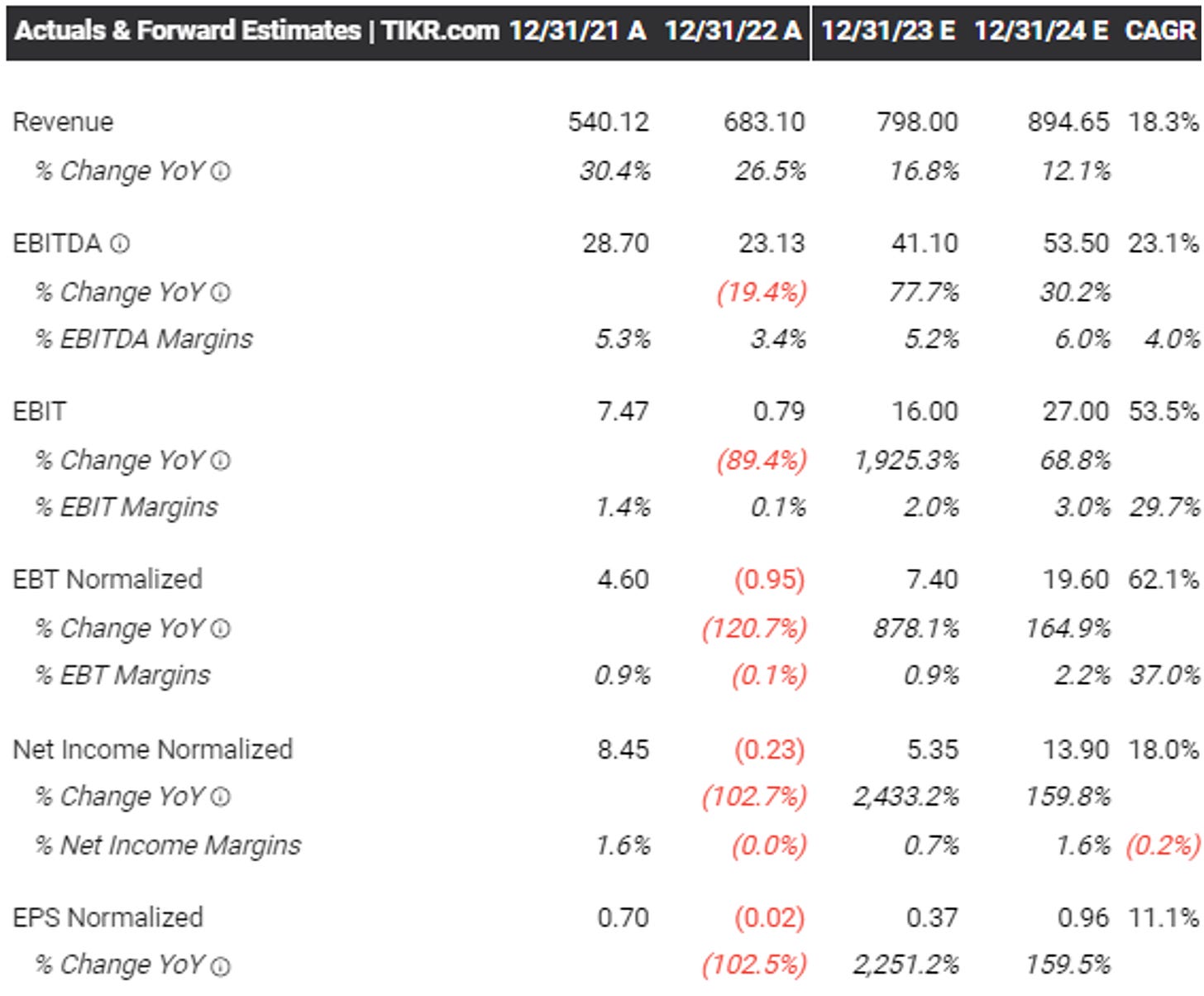

Why Bastide $BLC? In a nutshell: Bastide is an exceptional company in a resilient, highly fragmented sector, with strong insider alignment, high margins, high ROE, and currently trading at its lowest valuation in two decades.

Bastide's core business is the distribution of medical equipment and provision of home medical services, achieving steady revenue growth of 13%-15% over the last decades through organic growth and acquisitions, significantly expanding its margins.

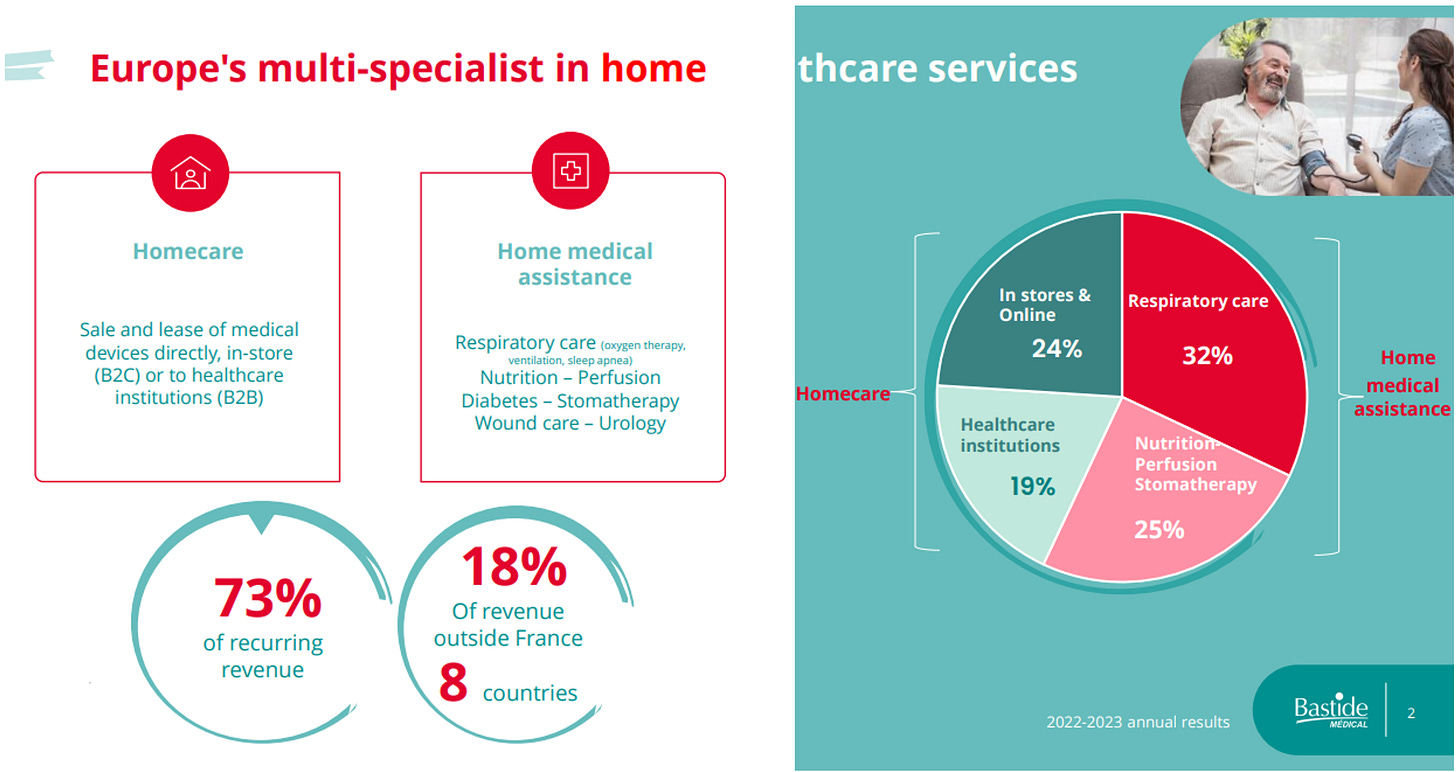

They divide their activities into two (or four segments):

Home Medical Assistance – Respiratory Care (32%): This was the first segment of the company, created by the founder. This segment is performing very well both in France and abroad, expanding mainly through the acquisition of small companies.

Home Medical Assistance – Nutrition, Perfusion, Stomatherapy (25%): The patient's return home after hospitalization sometimes requires continuity of treatment by infusion and/or artificial nutrition.

Home Care – In stores & online (24%): Selling or leasing medical equipment to individuals through their stores and online. Notably, they are shifting their strategy to accelerate growth by moving to a franchise model.

Home Care – Healthcare institutions (19%): Selling or leasing medical equipment to medical institutions.

82% of their revenues come from France, but they now have presence in 8 other countries.

The CEO, founder's son, draws a modest salary (200-300k€), with the family retaining over 50% ownership, ensuring aligned interests with shareholders.

Home healthcare market is expected to keep growing strongly 7%-9% over the next decade.

The company is trading at its lowest valuation. Investors might be concerned about their high debt levels, since interest payments increased by 50% in 2023 compared with 2022 due to rising interest rates, yet net profit also grew in 2023. I am not overly concerned about this, as the company still generates strong FCF, and its high debt levels are not unusual for Bastide, which leverages debt for inorganic growth. Additionally, over 70% of its revenues are recurrent, backed by long-term contracts.

Another reason could be that during COVID there was abnormal organic growth of more than 20%, and obviously, it is now normalizing in this post-pandemic time.

Outlook: Bastide expects to continue outperforming the market, primarily through organic growth and opportunistic acquisitions, with a focus on reducing debt amidst high-interest rates. 2024 Q1 results align with guidance.

In my analysis, I conservatively project 6% growth for 2024, accelerating to 9% thereafter, with stable operating margins. Applying a PE of 15x or EV/EBITDA of 6x—favoring PE in this case—suggests a stock potential performance of over 40%, a perspective I'm keen to discuss for any insights I might have overlooked :D.

SIGNIFICANT DEVELOPMENTS

Kontron $KTN.de

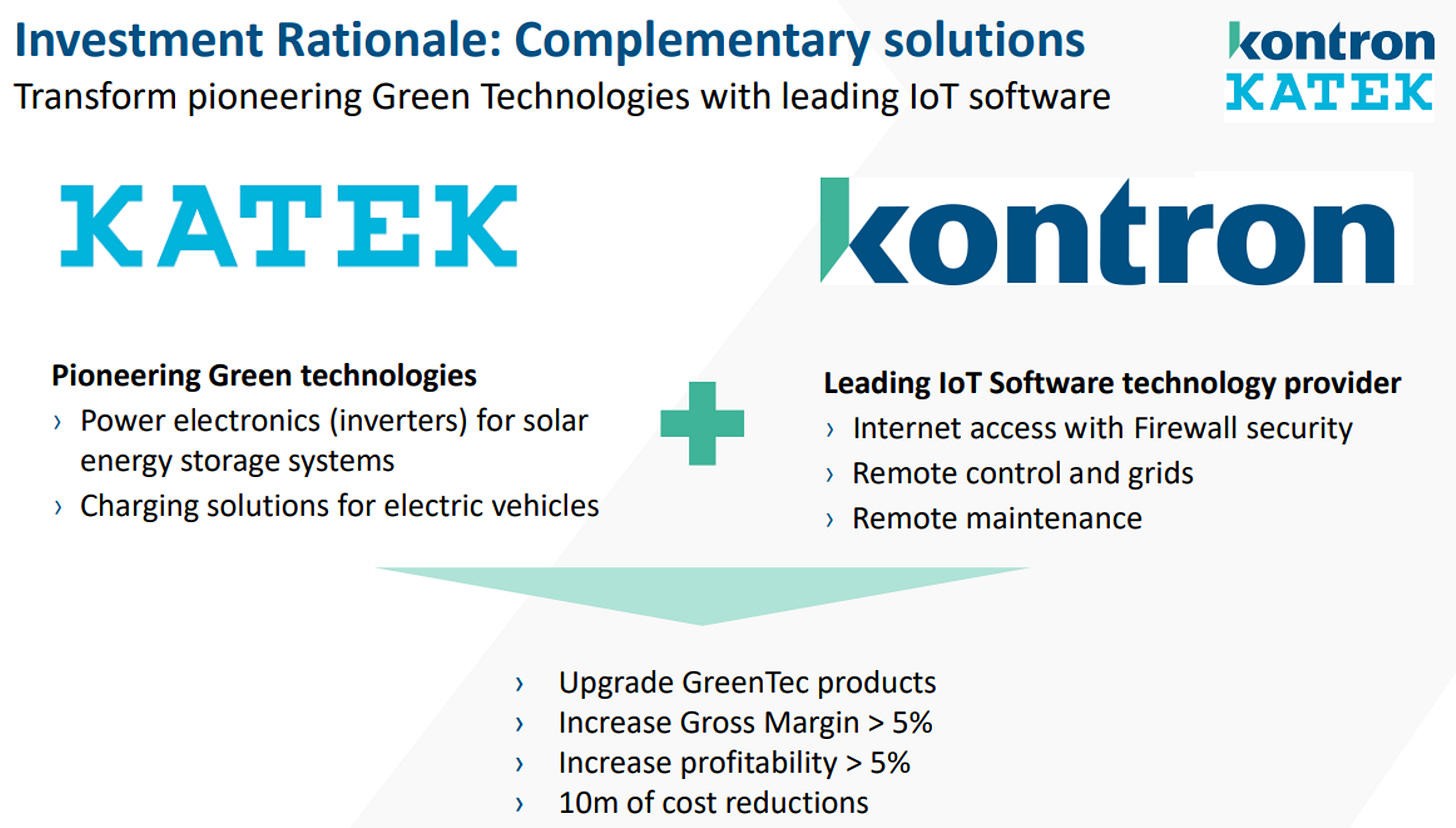

Kontron unveiled the last piece of “the new Kontron” following the divesture of the IT services to focus entirely on IoT. Despite previous skepticism, including my own, Kontron has now made it clear that it is not only on track to meet its mid-term revenue guidance of 2 billion euros by 2025 but also to surpass it significantly.

On January 18th, Kontron announced its agreement to acquire approximately 60% of Katek SE, a publicly traded company, from its primary shareholder PRIMEPULSE. This transaction, subject to regulatory approval, is expected to close by March 2024 and includes a subsequent offer to purchase the remaining shares. Valuing Katek at around 217 million euros in equity, this marks Kontron's largest deal to date and is poised to significantly boost its growth and solidify its standing as a leading provider in the IoT space.

Katek, a premier European electronics firm, specializes in high-quality electronics for solar energy and e-mobility, boasting over 3,200 employees and projecting sales exceeding 800 million euros for FY23. With a robust 21% CAGR over the past three years and expectations of continued growth, Katek's integration into Kontron is anticipated to enhance Kontron's product offerings with advanced solutions in renewable energies among other sectors. This acquisition aligns with Kontron's strategy to augment its products with its software and IoT capabilities, aiming for a 5 percentage point gross margin expansion in the medium term.

For the acquisition, Kontron will pay 217 million euros for the shares and an enterprise value (including net debt) of approximately 360 million euros, funding the purchase with its own cash reserves. This decision will also lead to the early termination of its share buyback program. However, the acquisition is viewed as financially sound, with Kontron securing Katek at a more favorable EV/EBITDA multiple (5.5x) compared to its own (8x EV/EBITDA for 2024E). Hence, from a valuation perspective (pre synergies), I see this acquisition as value accretive.

Moreover, the current consensus price target for Katek stands at 26.40 euros, indicating the market perceives intrinsic value well above the acquisition price, highlighting the deal's attractiveness.

Following this acquisition, Kontron has updated its FY24 forecasts, now expecting consolidated sales to reach at least 1.9 billion euros with a net profit of approximately 100 million euros.

As of now, I have not updated my model pending further details on when the acquisition will be fully integrated into Kontron's financials.

DIGITAL VALUE $DGV

Digital Value has been on my watchlist for quite some time, which led me to open a position in October 2023. I shared insights on this decision in a post, which you can find here. The journey since then has been quite impressive, with the stock climbing almost 50% above my entry price.

Value investing often tests one’s conviction, particularly when opting to buy into a stock that’s down 60%. Asserting a 25% margin of safety and estimating the fair value to be 40% higher than its market price highlights the importance of strategic patience and meticulous analysis inherent to value investing.

On January 31st, Digital Value made an announcement that exceeded expectations, reporting a 20% growth for 2023 despite prevailing economic headwinds. This performance is notable, especially with the stock’s price jump, yet it still trades at an attractive 6x EBITDA multiple.

These outcomes have outperformed my initial projections. My model, which took a more conservative stance for both 2023 and 2024, anticipated sales growth of 15% and 8%, respectively. However, I plan to hold off on updating my model until the publication of the final report, which is expected to include further insights into the market outlook for 2024.

Learning Technologies Group's $LTG

Learning Technologies Group ($LTG) released a full-year trading update, which, while at the lower end of their guidance, sparked a 17% jump in its stock price. Analysts, likely bracing for a third profit warning, were pleasantly surprised by the positive news. The update highlighted a margin recovery (depressed since the acquisition of GP Strategies) and stronger-than-expected cash flow generation, leading to significantly lower net debt than anticipated.

Furthermore, LTG also announced during the month the completion of the sale of two non-core business units acquired as part of the GP Strategies deal.

During their conference call, LTG noted the challenging environment within their sector over the past year, with some competitors experiencing revenue declines of up to 20%. In contrast, LTG managed to limit its organic revenue decline to just 2%, showcasing the resilience of its business model amidst industry-wide pressures.

The company has observed signs of a shifting market landscape but plans to withhold its 2024 guidance until the publication of its annual results in April.

Information Service Corp $ISV

Information Service Corp $ISV shared updates regarding its financial performance and future outlook through two press releases.

The first announcement confirmed that the company's full-year results for 2023 are in line with previously issued guidance.

The second release, issued in early February, provided a deeper insight into 2023's outcomes and introduced an initial forecast for 2024. This guidance is notably optimistic, projecting strong revenue growth between 16%-18% and an enhancement in profit margins.

Based on this new information, I have revised my financial model and adjusted my price targets for ISV accordingly. These updates reflect the company's solid performance in 2023 and its promising projections for 2024, indicating a positive trajectory for its business operations and financial health.

SOLUTIONS 30 $S30

Solutions30 closed 2023 with revenues up 16.7% to €1.06 billion, hitting their goal of crossing the billion-euro mark. The big win came from Benelux, where revenues jumped 71.9%, outshining other regions. France dipped slightly, but the overall picture remains strong.

Looking ahead to 2024, Solutions30 is optimistic, forecasting sustained revenue growth and further improvements in profitability. They're targeting double-digit EBITDA margins in each country, supported by strategic initiatives to optimize costs and enhance productivity across its operations. The plan is to keep financing growth internally, staying flexible and debt-smart.

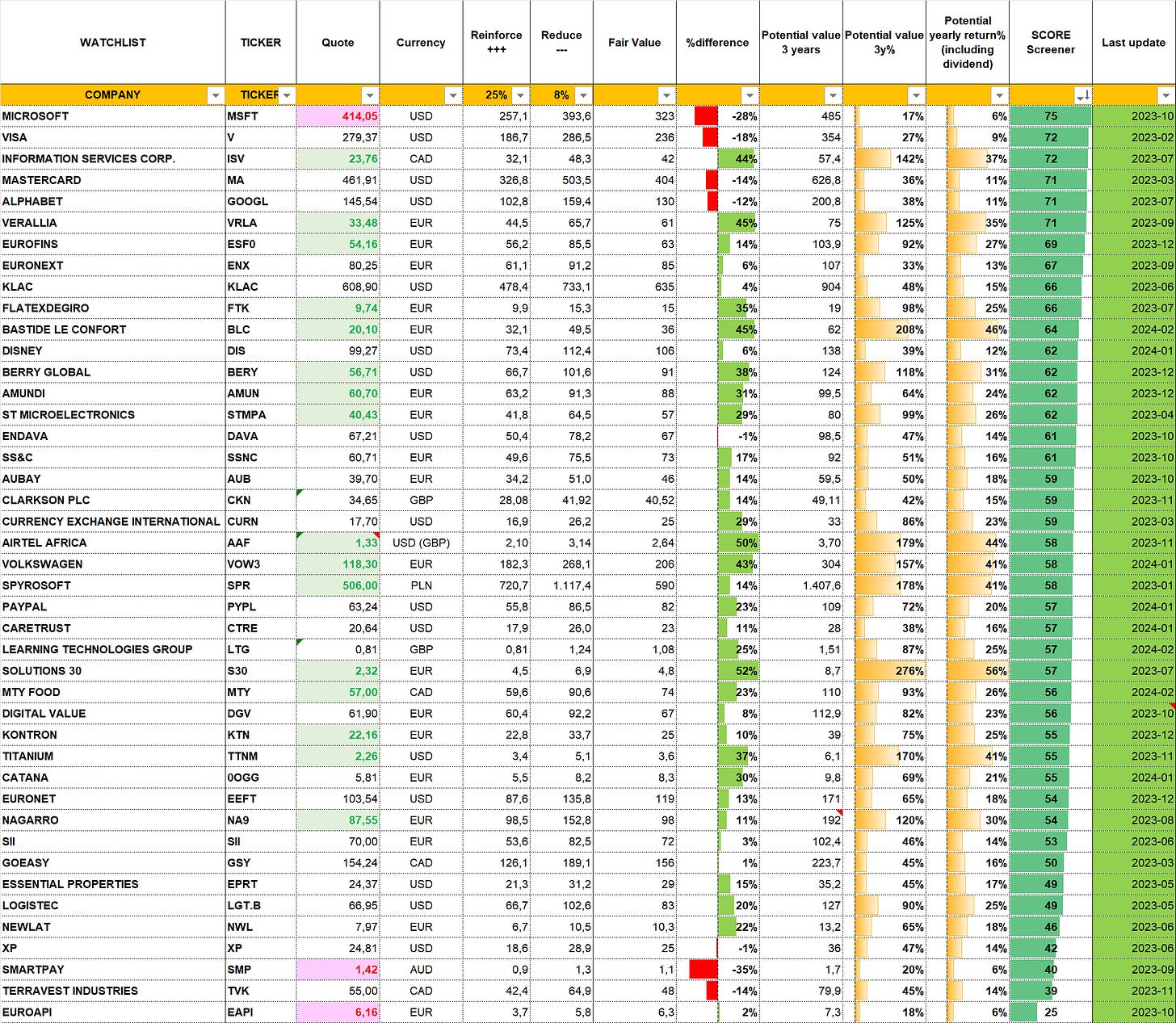

WATCHLIST UPDATE

Thank you for taking the time to read this update. Your feedback is always appreciated as it helps improve our investment insights and decisions. Looking forward to hearing your thoughts and engaging in valuable discussions.