2024/07-08: Watchlist Updates and Recent Moves

ST Microelectronics $STM, Eurofins $ERF, Digital Value $DGV, Verallia $VRLA, Solutions30 $S30 and a Personal Request :D

Ahoy, mates!

I didn’t post any updates over the summer, so this one will cover the last two months, highlighting key movements on my portfolio and some significant developments for companies on my watchlist.

As you know, this blog is a hobby. I usually write at night when the little ones are asleep. But with the school holidays, things got a bit tricky. The kids stayed up later, and we had plenty of family trips around Switzerland, Italy, and Spain. I was able to almost completely disconnect from the markets during the summer, feeling comfortable and well-diversified enough to do so. It was a time to truly savor the warmth of family and the joys of summer. I hope you too were able to chart a similar course and enjoy these moments to the fullest.

Index:

Portfolio Overview & Adjustments

Increased Investments

Reduced Investments

New Positions

Sold Positions

Options Portfolio

Significant Developments

ST Microelectronics $STM

Eurofins $ERF

Digital Value $DGV

Verallia $VRLA

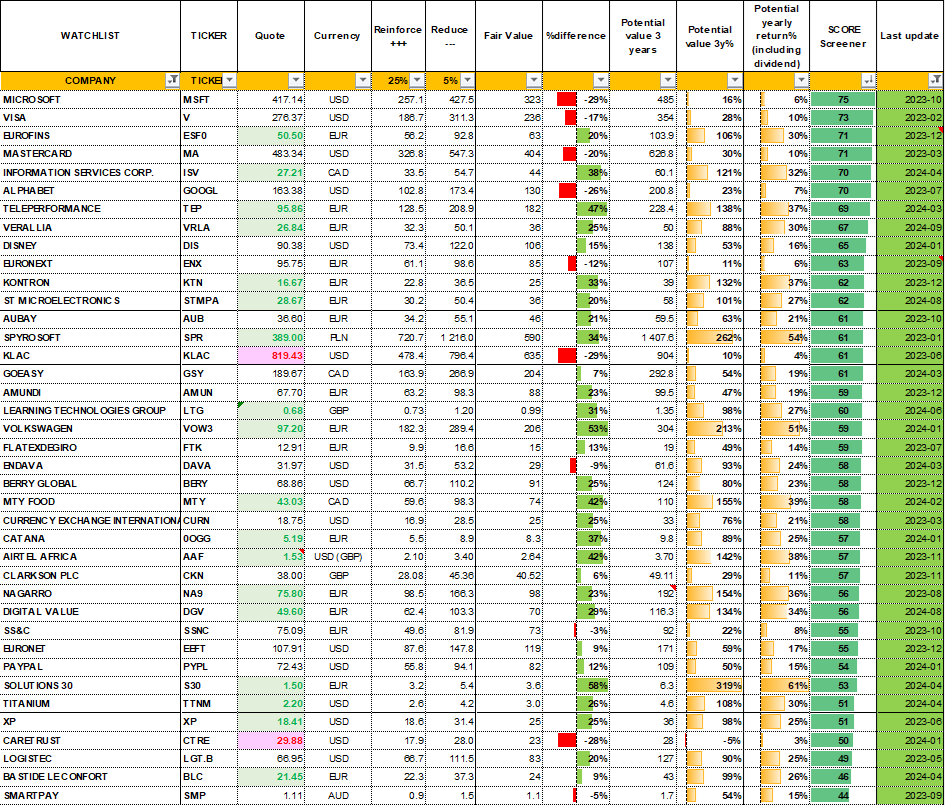

Watchlist Update

Personal Request: AG2R La Mondiale

PORTFOLIO OVERVIEW & ADJUSTMENTS

My portfolio experienced some modest swings, gaining 2% in July and giving back 2% in August. As I mentioned in my previous update, I’m in the process of buying a property in Switzerland, so I was a forced net seller, needing to pay about 20-25% of the property value in cash. Fortunately, it was finally less than expected, as I was able to reduce the upfront payment by providing some guarantees to the bank, securing a larger loan. However, I still had to liquidate part of my portfolio to cover the remaining amount. I’ll write an article about this soon, as promised.

Increased Investments: Verallia $VRLA, Kontron $SANT, Titanium Transportation Group $TTNM, Endava $DAVA, Paypal $3PYP, ST Microelectronics $STM

Reduced Investments: KLA Corporation $KLA, Alphabet $GOOGL, Microsoft $MSFT, Amazon $AMZN, SS&C Technologies $SSNC

New Positions: Aubay $AUB

Sold: Solutions30 $S30

As I mentioned in my June update (→link), I’m still very bullish on the companies I’m reducing position. However, there’s a big gap in valuations between large caps and small caps, so I have been shifting more of my portfolio toward the latter.

For example, regarding Alphabet $GOOGL, it’s still my largest holding, but instead of 11% as it was in Q2, it’s now around 6-8%. I doubled my position when it was trading between 85-95$ at the end of 2022 - beginning of 2023. I have reduced 25% of my stake between June and July, at around 185-190$.

Regarding Solutions30 $S30, a long-standing part of my portfolio, I’ve finally decided to sell. Last year, I shared an interview with William Higgons, where he mentioned that, despite being value investors, they believe in Momentum. Every six months, they make it a rule to sell the worst-performing stock. You can find the interview and his reasoning here, which I found intriguing.

I recently came across a letter from Giverny Capital (2024Q1, I copy some fragments herebelow), which resonated with my thoughts on my portfolio. I have a few companies where I’ve held small positions for a long time, believing they are highly undervalued, yet they’ve contributed little to my portfolio’s performance. Don’t be surprised if I start trimming the tail of my portfolio as well.

Looking at Solutions30’s numbers, they’ve managed to multiply their revenue tenfold over the last 10 years (thirtyfold over the last 15!). They’ve grown every single year, even during the 2008 crisis and COVID, all without diluting shareholders—growing solely through their generated cash flows. However, they’re likely operating in a challenging market that’s constantly shifting, with new issues cropping up, whether political or with telecom companies. While they used to deal with these challenges primarily in France, they now face them in Spain, Italy, Belgium, and beyond.

I’ve developed a lot of respect for their founder and CEO, Mr. Fortis, who not only draws a modest salary but also owns 17% of the company. I think he’s doing an excellent job of maintaining profitable growth. But for me, it’s becoming increasingly draining to keep up with the company. I’ve decided to take Mr. Higgons’ advice and start cutting my losses. Like Mr. Rochon, I’ll be working on reducing the tail of my portfolio. This semester, that means letting go of Solutions30. The funds will be redirected to companies where I’m more bullish.

OPTIONS: Some of you have asked about my options portfolio privately, so I’ll start including updates on that as well.

Right now, I am only holding short-term PUT options. To give you an idea of my exposure, if these puts expire without being exercised, the premiums collected will add about 2-3% annualized yield to my total portfolio performance. If the puts are exercised, I’ll be happy to add more of these companies to my portfolio at those prices. The underlying value of these contracts is approximately 7%-10% of my total portfolio.

In July, I sold puts on Nagarro at €70 with an expiration on August 16th. The contracts weren’t exercised, so I collected the premiums—equivalent to approximately 0.2% of my total portfolio value (annualized 2.4%).

In August, I sold puts on Nagarro again, this time at €69 with an expiration on September 20th. I also sold puts on Teleperformance at €97, expiring on September 20th. If neither is exercised, the premiums will contribute 0.26% to my portfolio performance (annualized 3.12%).

SIGNIFICANT DEVELOPTMENTS.

ST Microelectronics $STM

ST Microelectronics published their Q2 results along with a FY2024 profit warning—their second one this year! While they were expecting a recovery in the second half, they don't see it coming yet.

The reasons for this decline have been laid out—the company is heavily exposed to the industrial and automotive sectors, where we’ve been seeing the bullwhip effect in demand in full force since COVID.

ST Microelectronics has a certain cyclicality, and we might be seeing the bottom of the cycle now or soon… The current valuation is even lower than during the COVID bottom. Naturally, investors weren’t thrilled to update their models after two profit warnings in just three months. They were guiding for FY2024 revenue of $16B to $17B with further margin improvements, but now it's been revised down to $13.2B to $13.7B.

However, even with this cyclicality and a >20% sales decline this year, they’ve still managed to steadily increase sales by 8% annually over the last 10 years and grow EPS at a ~30% CAGR. The company was repurchasing shares but have strongly intensified after the price dropped, averaging >10m€ per week.

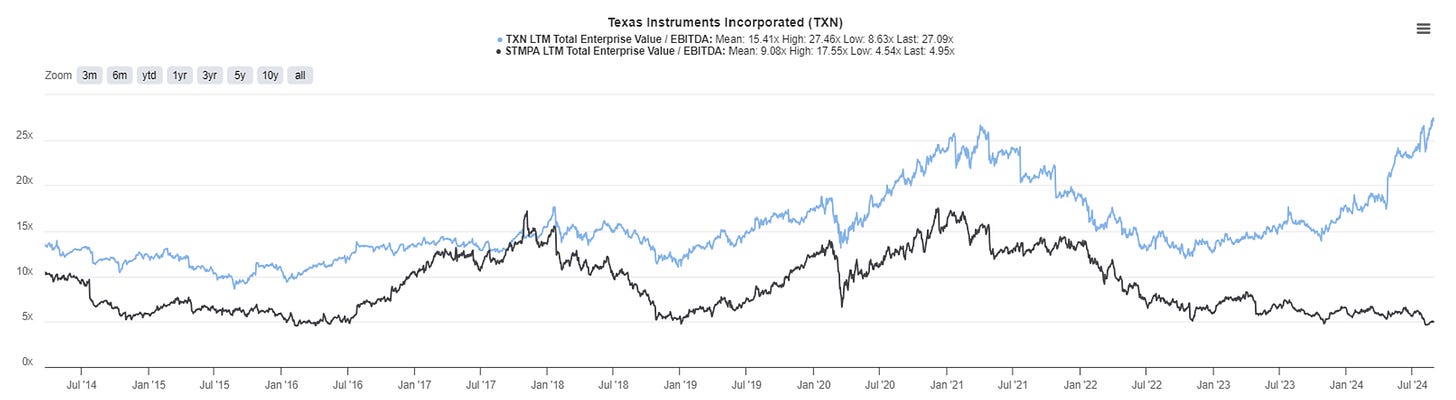

I believe it’s significantly undervalued, especially compared to its American peer, Texas Instruments $TXN, which had very similar results but is trading at all-time highs. I’ve slightly increased my position and am looking forward to the Capital Markets Day on November 20 to gain more clarity.

Eurofins $ERF

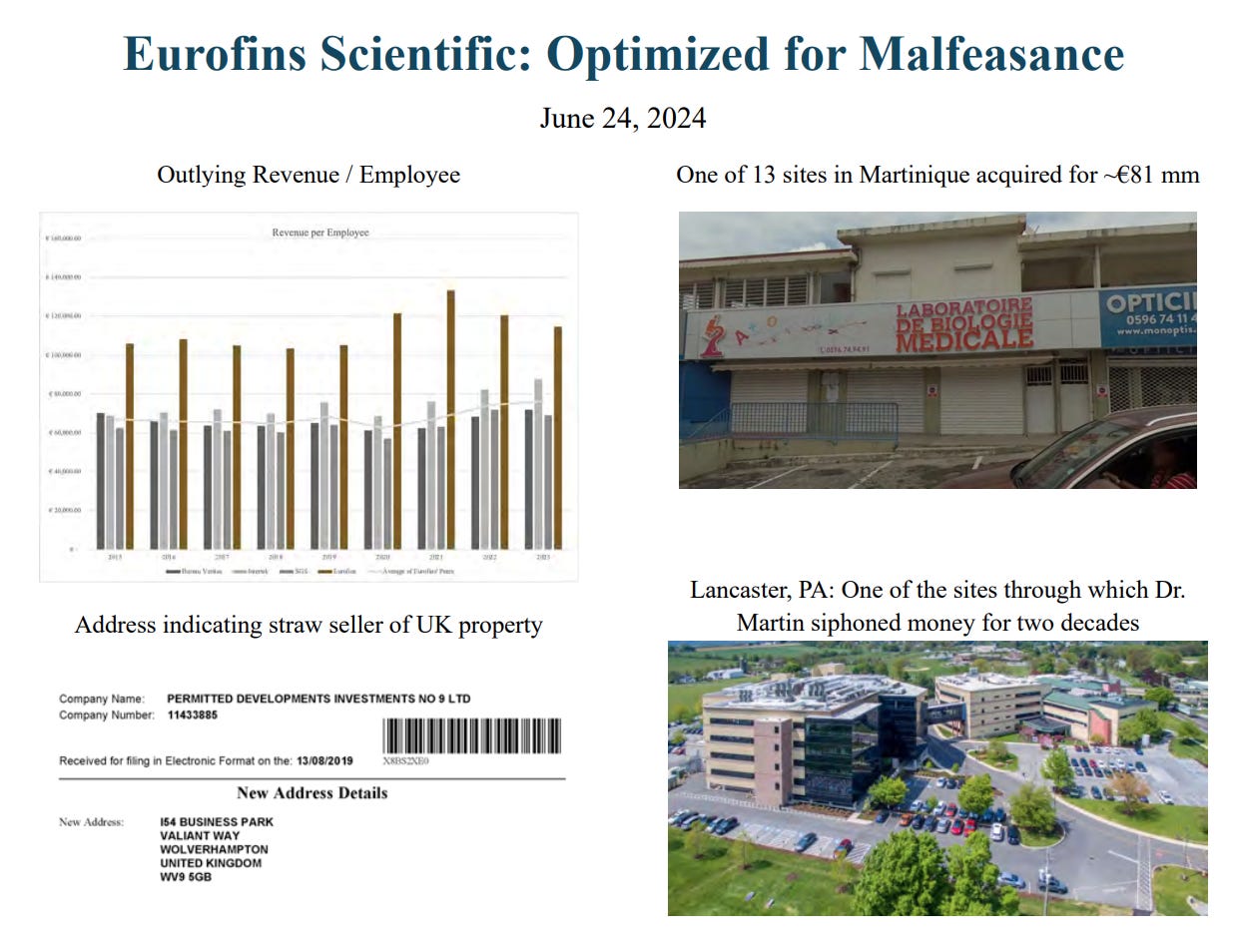

Eurofins came under attack in a short-seller report at the end of June, causing its price to drop nearly 20%. This came after a challenging period in which Eurofins dealt with global pricing pressure on its core diagnostic testing services. The short-seller report raised some valid points: Eurofins has long had numerous transactions with its founder and CEO, Dr. Gilles Martin, who personally owns some laboratory facilities and leases them to the company. These transactions, including the rent levels paid to Dr. Martin, are disclosed and are not new. For 25 years, these relationships haven’t stopped Eurofins from being one of the best-performing stocks in Europe.

That said, I found the report generally weak and filled with questionable claims, such as their misunderstanding of Eurofins’ business model. Among other things, the short sellers mistook Eurofins for an inspection and certification business rather than a laboratory testing company. As a result, they questioned the company’s productivity metrics, comparing it to the wrong peer group.

The stock was extremely volatile for a few weeks, with pessimists pointing out that if it remained at those levels in September, it could be removed from the CAC40, which could push the stock further down. I took advantage of this opportunity to increase my position by 25% at around €40.

Meanwhile, Eurofins announced its second-quarter results in late July and published the H1 report. The results were exceptional—record-breaking as expected, well above their 2021 figures when they benefited from COVID contracts. The company reported healthy testing volumes, stronger margins, and a sizable stock buyback (nearly a million shares during H1). They also reconfirmed the guidance given at the beginning of the year and their midterm objectives.

The stock is now more or less back to the level it was at before the short report was published.

Digital Value $DGV

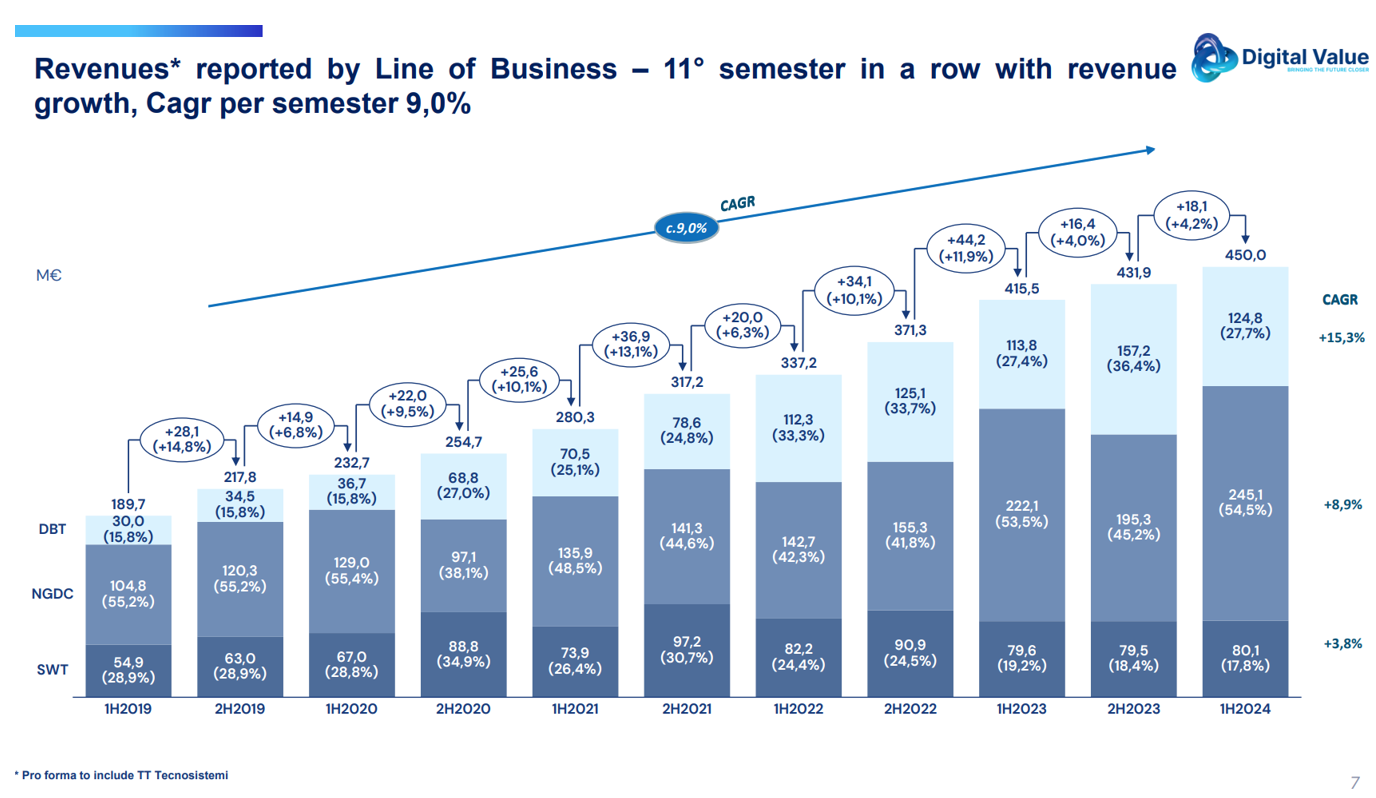

Digital Value reported preliminary H1-24 figures showing 8.3% revenue growth and strong cash flow generation. Management expects to return to double-digit organic growth in the second half.

Total revenues came in at €450 million, once again outperforming the reference market, which is expected to grow by 5-6%.

In terms of business lines, the Data Centre division continued to drive sales growth, now accounting for 55% of the total. Digital Business Transformation was also up thanks to Cloud solutions and software platforms, as well as system integration activities and cybersecurity services. Smart Workplace Transformation remained steady year-over-year at €80 million.

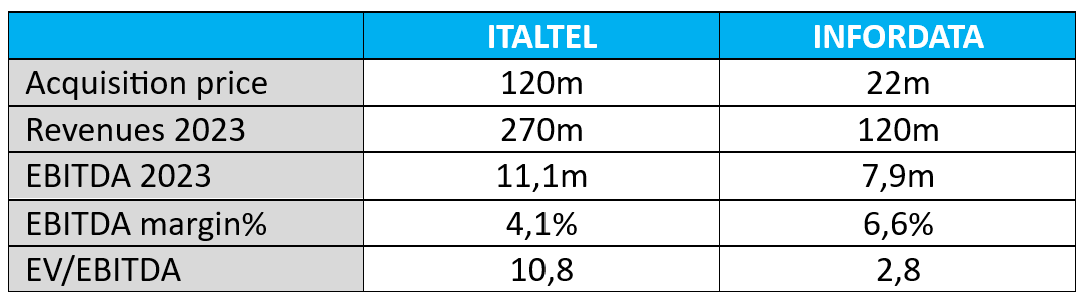

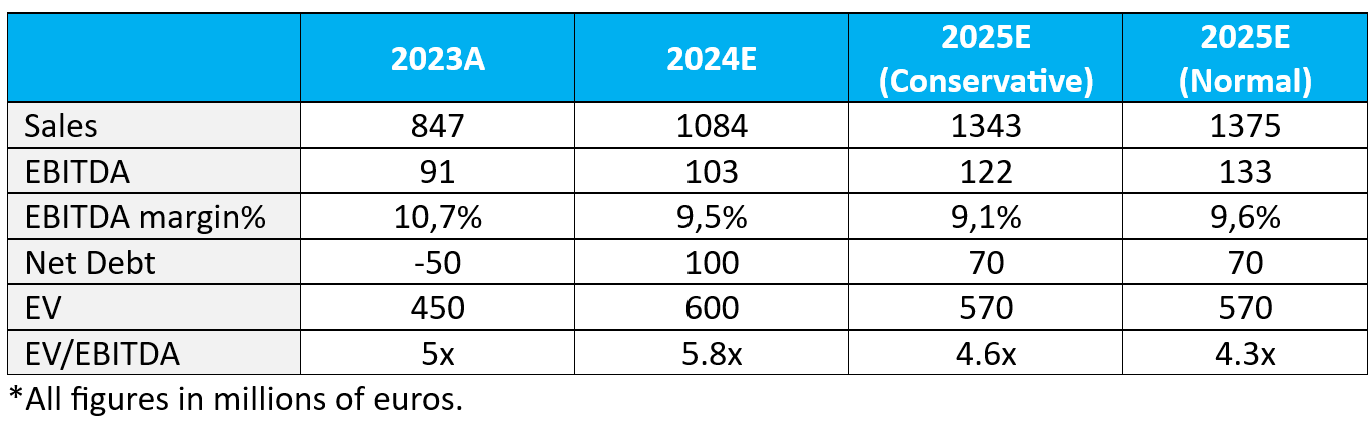

So far, nothing surprising. The big news came in June when they announced two acquisitions: Italtel and Infordata. Here are some key figures for each transaction:

Infordata's acquisition was in line with previous ones, but I was surprised by how much they paid for Italtel. DGV is currently trading at 5x EV/EBITDA, yet they paid more than 10x for Italtel, a company with much lower margins that has just gone through restructuring to be sold.

However, they claim that Italtel will grow more than 10% this year, pushing revenue over €300 million, and that the ongoing turnaround process will lead Italtel to an EBITDA margin of 7-8% before integration synergies with Digital Value (compared to the current 4%). This could reduce the acquisition multiple to around 6x EV/EBITDA pre-synergies.

Even if the acquisition doesn’t go as smoothly as expected, I still see DGV as significantly undervalued. We’re yet to see when these companies will be fully consolidated, and for simplicity, I’ve assumed a mid-year consolidation in the table below, which isn’t realistic. However, 2025 should give us a clearer picture of what the new DGV will look like, even with very conservative estimates for organic growth and potential synergies.

Lastly, the CFO resigned to pursue new challenges. No further comments on that.

Verallia $VRLA

Verallia issued a profit warning alongside their H1 results, and the stock took a hit, dropping over 20% since. The glass market has been under pressure since 2023 due to destocking and supply chain disruptions, but the company pointed out that the recovery is slower than expected. As a result, they've adjusted their 2024 guidance, now anticipating flat to slightly down volumes for the year and an EBITDA similar to 2022 levels, with a revenue decline of around 10%.

The company expects demand to gradually pick up as destocking winds down, though the exact timing remains uncertain. They remain optimistic that the trend toward premium products will continue, potentially driving future growth.

While it’s still early to determine the dividend policy for next year, Verallia hinted at the possibility of maintaining a stable dividend, which should be reassuring for income-focused investors.

I took advantage of this price drop to slightly increase my position.

WATCHLIST UPDATE

And as always, I anchor this post with an update on my Watchlist.

Personal Request: AG2R La Mondiale

Last but not least, a small favor—this isn’t related to investing, but I could use your support. I worked for a French company for nearly 15 years, and during that time, I contributed to a retirement scheme called PERE (Plan Épargne Retraite Entreprise) managed by AG2R La Mondiale. I was satisfied with the management of this scheme; it functioned like a typical robo-advisor. However, after I left France two years ago and settled in Switzerland, I stopped the contributions.

About a year ago, without any notice, AG2R transferred and froze my entire pension fund into their own monetary funds, with expected annual returns between -1% and 1%. If my pension stays there until retirement, I stand to lose it entirely. Normally, I could transfer this fund to a similar scheme in another company, but as a foreigner, I’m not allowed to open a new one while living abroad, and they don’t accept transfers to foreign schemes either.

I contacted the European Commission, which informed me that this practice is indeed illegal, but since I reside in Switzerland, they’re unable to intervene. My only option now seems to be finding a lawyer.

To put some pressure on AG2R through social networks, I’ve created the account @AG2R_OuEstMonAr. If you don’t mind, please help by retweeting the thread pinned to my profile. I’ve noticed their Press Manager is already following the account, so I know they’re paying attention. And hey, if you’ve made it to the bottom of this post, you deserve a hearty thanks—your support keeps me motivated to keep writing.

AG2R, you can’t rob a pirate and get away with it! ⚓️

Thanks,

Guybrush

try solvit ? https://ec.europa.eu/solvit/index_fr.htm