Happy New Year! Wishing all my readers a stellar start to 2025, filled with peace, health, and plenty of prosperity.

As we close the books on 2024, it’s time to weigh anchor and take stock of how our treasure chest (a.k.a. investment portfolio) held up amidst the year’s market waves—both the storms and the calm seas.

Here’s what we’ll cover in this review:

Portfolio Composition & Performance

Portfolio Composition as of December 31, 2024

Compounding

Geographical Allocation

Key Learnings and Adjustments in 2024

Top performers of 2024

Underperformers of 2024

Q4 Portfolio Changes

New Additions

Wavestone $WAVE

Sells

Portfolio Adjustments

Options

Watchlist 2025

The big picture

Stock-Picking Portfolio

Private Pension Plans (2nd & 3rd Pillar)

Real Estate

Hedge Funds Picking Portfolio

Cash & Short-Term Monetary Funds

Bitcoin

Looking Ahead to 2025

Portfolio Composition & Performance

Portfolio Composition as of December 31, 2024

The portfolio now holds 30 positions, slightly above my ideal range of 20–25. Despite this, it remains focused, with the top 10 positions accounting for 52% of the portfolio and the top 20 making up 81%.

During the year, I sold 7 positions and added 6 new ones (highlighted in yellow in the table). The average holding period is now 3.3 years.

Compounding

My portfolio delivered 7.1% in Q4, pushing the full year performance to 12,9%. While this year’s gains lagged major indexes like the MSCI World (+19%), Nasdaq 100 (+25%), and S&P 500 (+23%), a 13% annual return is solid. More importantly, the five-year CAGR stands at 16.4%, well above my double-digit target.

Performance by Quarter (2024):

Performance by Year (Historical):

Geographical Allocation

The portfolio’s geographical split shows a heavy European bias (49%), with 40% in the US and 11% in Canada.

US Stocks: +30% average performance.

Non-US Stocks: -6% average performance.

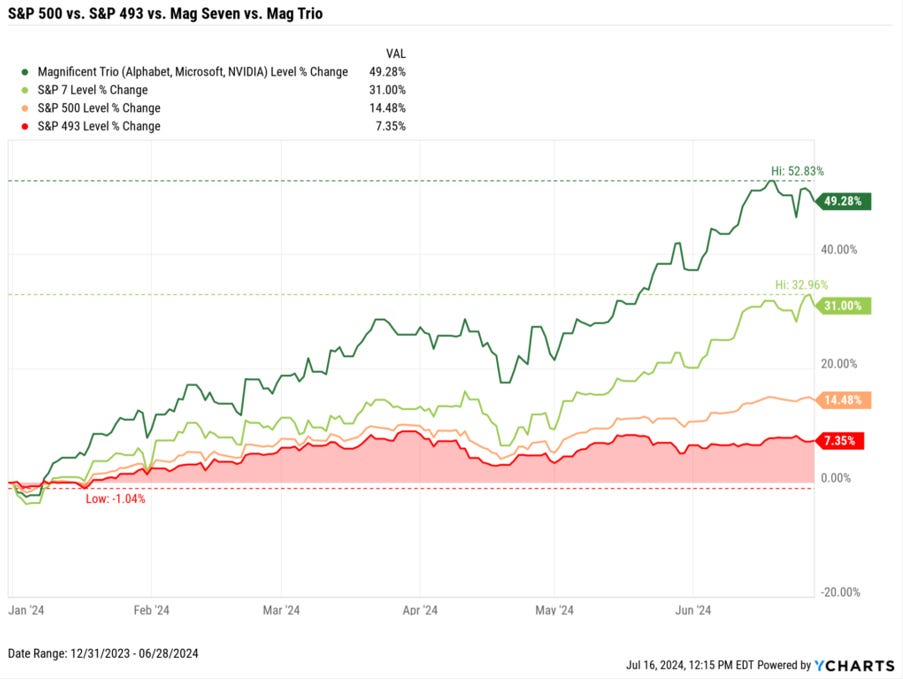

This divergence reflects broader trends. Major indexes were driven by the “Magnificent Seven”, while European markets, particularly small caps (60% of my portfolio), underperformed.

MSCI World Ex-US: +5%

MSCI Europe: +2%

MSCI Europe Small Cap: +6%

The following graphics illustrate key dynamics:

The S&P 500 “Magnificent Seven” returned 31% during the first 6 months, while the remaining S&P 493 gained just 7%.

The weight of the “Magnificent Seven” in the S&P 500 grew from 1% to 34% over the last 30 years.

I’m not trying to justify my performance here, nor do I believe there’s necessarily a bubble in the top 7 US stocks—I even hold a few myself. However, I do think the current price/performance divergence between these giants and the rest of the market will eventually normalize. This belief underpins my preference for staying diversified, rather than chasing concentrated gains.

At the same time, I hold a strong conviction that Europe offers significant opportunities, even amid challenging economic conditions. It’s remarkably easy to find highly undervalued companies whose stock prices don’t yet reflect their underlying performance. Here are a few examples from my biggest European holdings, which illustrate this disconnect:

The only one with positive performance in 2024 was Euronext, which delivered an impressive +40%. Yet, even with that strong result, it remains highly undervalued compared to its peers. For context, I was able to buy Euronext in 2023 at just 10x PE—a clear bargain.

If we evaluate these holdings purely by stock price performance, they didn’t shine in 2024. However, I remain confident in them, as each has strong fundamentals and clear catalysts that could unlock their value in 2025. It’s no coincidence that 5 out of the 6 stocks I added in 2024 are from Europe, where I continue to see deeply undervalued opportunities.

Key Learnings and Adjustments in 2024

This year, I’ve made a conscious effort to give more weight to momentum and avoid the classic value investor trap of adding to a position as it continues to decline. While the logic says a lower price makes a fundamentally strong company more attractive, the reality is that persistent price drops without news often precede negative developments. This is especially true for stocks with informed shareholder bases or insider activity, where the market might already sense upcoming challenges.

That said, I don’t avoid buying declining stocks altogether. Instead, I’ve started obliging myself to sell some underperformers at regular intervals, and it’s paid off. Of the 7 positions I sold this year, 6 are now trading below my selling price.

Another adjustment I refined in 2024 was a clear separation between long-term and short-term portfolios, something I started in 2023. I now use two brokers:

Long-term holdings: The core portfolio.

Short-term/speculative trades: This portfolio represents roughly 5–10% of total portfolio weight. I limit it to no more than 4–5 positions at a time, including options, and frequently use margin.

The short-term portfolio outperformed significantly this year, delivering 33% returns versus 10% for the long-term portfolio. I took advantage of high volatility within my long-term positions, using a mix of tactical buying/selling and options strategies (mainly call options and selling puts). These options strategies alone added 1.4% to overall portfolio performance.

This year, I’ve made a point to focus more on understanding a company’s moat—how strong and durable it really is. It’s not that I wasn’t looking at moats before, but in the past, I relied on a checklist with questions that gave the company a score. While helpful, I didn’t spend much time digging deeper, and sometimes the score wasn’t really relevant.

I’ve passed on many high-growth companies with seemingly innovative products because I wasn’t convinced their advantages would last. Some of those stocks have done well, others not, but I’ve stayed disciplined about sticking to businesses with clear, defensible edges.

Top performers of 2024

Paypal $PYP

Under CEO Alex Chriss, who took over in late 2023, PayPal has shifted focus to profitable growth and innovation. Key initiatives included launching “Fastlane”, a one-click guest checkout feature designed to improve user experience and boost transaction success rates. The company also ramped up its share buybacks, retiring about 10% of its shares between 2023 and 2024, while reining in stock-based compensation.

PayPal’s stock gained 38% in 2024, but my investment in $3PYP, a leveraged ETF, delivered a 92% return. A few readers have asked why I chose $3PYP instead of the stock. Here's why: I used to hold PayPal in my long-term portfolio, but by mid-2023, when the stock hit $50 (below 10x PE, compared to its historical range of 20–30x), I saw an opportunity for a speculative position. Instead of call options, I opted for $3PYP, which offers less upside but more flexibility to adjust the weight of the position as needed. Its volatility has worked in my favor, and overall, I’ve gained ~150% on this trade—though it remains a very dynamic position.

Newlat Food NWL 0.00%↑

The acquisition of Princess and the formation of the new group New Princess was a game-changer. The market quickly recognized how undervalued Newlat had been, which drove the stock up. After the acquisition, I decided to sell my entire position, preferring to wait and see how the integration of Princess plays out before re-entering.

Euronext $ENX

Nothing particularly groundbreaking happened this year—it was simply a case of valuation catching up with reality. In 2023, Euronext was trading at a historical low PE of 10x, a bargain for such a dominant player in its space. This year’s performance reflects that undervaluation being corrected.

FlatexDegiro $FTK

FlatexDegiro had an impressive year, with sales growing by nearly 20%, improved profitability, and continued strong growth in new customer accounts. Additionally, regulatory concerns eased significantly after BaFin closed its file on the company, following the resolution of deficiencies flagged in 2022.

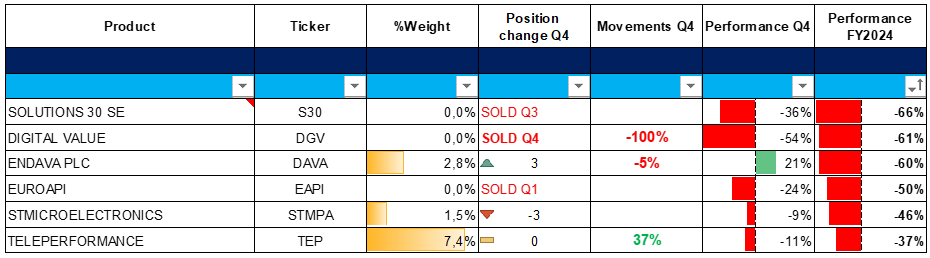

Underperformers of 2024

Most of these have already been discussed in previous updates, but here’s a summary:

Solutions 30 $S30: I commented here. I sold during summer, limiting my exposure to about half of the decline. If the company gets back on track to meet its 3–5 year outlook, it would be trading at less than 1x EBITDA, making it worth watching for a potential rebound.

Digital Value $DGV: This position was hit hard by a corruption investigation related to public procurement contracts and the resignation of its Chairman, CEO, and major shareholder, Massimo Rossi. I sold shortly after the news broke and commented further here.

Endava $DAVA: Endava caught me off guard. At the end of 2023, it was the best performer in its sector, outperforming peers who were posting profit warnings. But in early 2024, Endava saw a sharp decline, effectively catching up to what its competitors had suffered over the past two years. The worst seems to be over now, though, and the stock has started to rebound slowly.

Euroapi $EAPI: This was a win in disguise—I sold in January, avoiding the decline. Euroapi, spun off from Sanofi, came with ambitious plans in its IPO prospectus. However, as the pharma CDMO market normalizes post-COVID, Euroapi has struggled. It’s now undergoing a restructuring program that should have been addressed before its IPO. Well played, Sanofi!

ST Microelectronics $STMPA: Down nearly 50% this year, though it’s still trading only slightly below my average purchase price. I probably should have sold earlier. STM is heavily exposed to the industrial and automotive sectors, both highly cyclical industries. However, even at the low point of the cycle, the company manages to keep growing and maintains decent margins. Between 2018 and 2023, STM had an impressive 500% rally, peaking in 2021-2022 during the post-COVID chip crisis and supply chain disruptions. Interestingly, its U.S. peer, Texas Instruments ($TXN), despite facing similar pressures—like price declines and cyclical headwinds—didn’t suffer such a sharp decline of price.

Teleperformance $TEP: I wrote an article about it (link) and wouldn’t change a single word. Despite opening a position in 2023, the stock is trading just slightly below my average purchase price, thanks to options strategies and weight adjustments. This year, I’ve sold puts and bought calls when the stock traded between €80–90, while trimming my position at €100–120. Teleperformance has been extremely volatile, but this has made the option premiums very attractive.

It’s astounding that the stock is still down 80% from its all-time high, now trading at just 5x PE. While its performance hasn’t turned around yet, I remain cautiously optimistic. See for yourself.

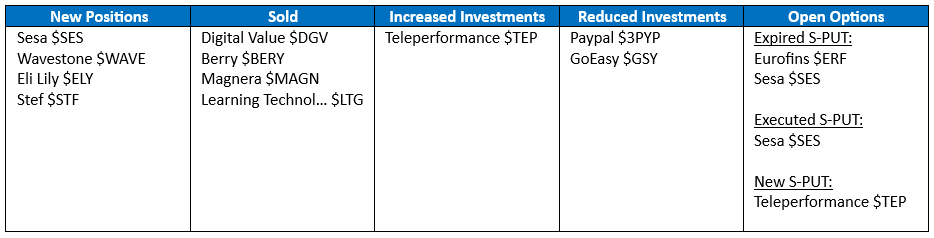

Q4 Portfolio Changes:

The 2024 new additions are marked in yellow in the table above and have been commented on in previous quarterly updates. This section will focus on changes specifically related to Q4:

New Additions:

Sesa $SES, Eli Lily $ELY and Stef $STF were commented in October update (link).

There is a lot of negativity surrounding Sesa ($SES), with the stock down nearly 70% from its all-time high. The decline appears to stem from multiple factors: a previous higher valuation, combined with a price rally that attracted weak hands, higher interest rates reducing profitability, a weakened Italian IT market over the past two years, and the Digital Value scandal in Q4, which further impacted sentiment. At current prices, I see a great opportunity and have been increasing my position.

Wavestone $WAVE

In December, I added Wavestone ($WAVE) to my portfolio. Briefly, Wavestone is a management consulting firm focused on business transformation, helping organizations improve operational efficiency, manage digital transformation, strengthen cybersecurity, and navigate regulatory environments. The company operates across industries such as financial services, energy, industrial or public sector, with a strong European presence and growing international reach.

Wavestone is a high-growth company, historically growing at an average rate of 15%-20% per year through a mix of organic expansion and strategic acquisitions, while avoiding dilution. The company maintains a ~20% ROE, and its margins have improved steadily over time. In 2023/24, Wavestone made a significant acquisition that slightly compressed margins, though this is likely temporary as the integration progresses.

The founding family remains actively involved, holding a significant ownership stake, which aligns their interests with shareholders.

Despite its strong fundamentals, Wavestone is currently trading at a historical low valuation of P/E 10x. Over the last four years, the stock has been stagnant, even though the company has more than doubled in size, making it significantly undervalued compared to peers in the consulting sector.

Sells:

Digital Value $DGV, I commented in October update as well.

Berry Global ($BERY) and Magnera ($MAGN)

I decided to sell Berry Global ($BERY) after the announcement of its merger (or acquisition) by Amcor. I had held $BERY since late 2021 and achieved a total return of +46% (CAGR 14%), making it a solid investment overall. From the outside, the move looks like a great deal for Amcor shareholders, but less so for Berry.

I considered buying Amcor, but this is a massive merger, and as the Einstein and Marilyn story goes, it’s not guaranteed the strengths of both will shine through. Plus, with so many opportunities in the market right now, I decided to stay out.

As for Magnera $MAGN, I received it as a spin-off dividend from Berry shortly before Amcor’s announcement—likely part of a pre-arranged plan.

Learning Technologies Group ($LTG):

Over the last three months, I’ve traded in and out of $LTG three times, taking advantage of its high volatility. The stock fluctuated between 87 and 96 pence after news of a potential takeover bid surfaced. When the offer was confirmed at 100 pence, the stock briefly rallied.

Recently, the price has been drifting lower, likely due to concerns that General Atlantic, the private equity firm behind the bid, might face challenges securing the necessary agreements to complete the deal.

Portfolio Adjustments:

I reduced my position in GoEasy ($GSY), not due to any fundamental issues—the company is performing exceptionally well, like a Swiss watch. It continues to grow 20% annually, with EPS growth exceeding 30%, even during crises. However, the stock remains extremely volatile.

This year, I reduced my position in Q1, Q2, and early Q4, selling between 180–190 CAD. While I believe GoEasy should trade at 400 CAD, it consistently trades within a range of 2–3x book value (with occasional lows near 1x). In 2020, the stock dropped >50%, allowing me to buy at 30 CAD. It then rallied to 210 CAD before falling again in 2022 to 90–100 CAD, where I doubled my holdings. By 2024, it surged back to 200 CAD, prompting me to trim my position.

Paypal $3PYP: after this year’s rally, I’ve reduced my position as I see less upside.

Options:

Some of my Sesa $SES contracts were executed last month, adding the stock to my portfolio. After further studying the company, I decided to increase my position in December.

I also have short put options open on Teleperformance $TEP at €80–82, expiring in less than a month.

Watchlist 2025

Here’s my watchlist for 2025, where I track stocks that could be worth adding to the portfolio. Each is ranked based on valuation, potential returns, and my screening criteria. It’s a simple way to keep tabs on potential opportunities.

The Big Picture

While the stock-picking portfolio remains the cornerstone of my investments, it’s just one piece of a larger puzzle. Here’s how my assets are distributed, how they performed in 2024, and what changes I’ve made to ensure a balanced and resilient portfolio moving forward:

Stock-Picking Portfolio:

The largest chunk of my portfolio at 57%, this delivered a 13% return, making it again the strongest-performing category among my assets this year.

Private Pension Plans (2nd & 3rd Pillar):

These represent 15% of my assets, delivering a 7% return in 2024.

Real Estate:

In 2024, I purchased my first property in Switzerland, which now represents 14% of my assets. I wrote a detailed article about the experience for my Swiss readers, though it’s not publicly available.

Hedge Funds Picking Portfolio:

Representing 7% of my assets, down from 13% last year, as I used part of these funds to help finance the Swiss property purchase. These funds delivered a 6% return overall, with Numantia Patrimonio standing out with a stellar 28% return.

Cash & Short-Term Monetary Funds:

Currently 4% of my assets, down from 17% last year. The main reason for this reduction is a real estate investment in Switzerland, funded largely by these monetary funds. This year, they delivered a 2.8% return, though this figure is skewed by timing, as a large portion of dividends was received at the year’s end, based on the average portfolio value.

Bitcoin:

Now 3% of my portfolio (up from 1.6% last year), Bitcoin had an extraordinary year, delivering more than 130% return.

Over the last few years, the stock-picking portfolio has grown to dominate my overall allocation, now representing 57% of my assets. While it’s been the strongest performer, this level of concentration increases risk. My goal for 2025 is to gradually rebalance the portfolio, not by selling existing positions, but by allocating new savings to other areas like real estate, pension plans, and hedge funds.

This shift will help create a more balanced and resilient portfolio, allowing me to diversify further while continuing to pursue long-term growth opportunities.

Looking Ahead to 2025

As we enter 2025, I want to take a moment to thank all of you—longtime readers, new subscribers, and especially those I’ve had the pleasure of connecting with through this blog. This marks the end of my second year writing Guyquity, and I couldn’t be more grateful for the conversations, feedback, and support from this amazing community.

This year, life’s currents will leave me with less time to write, but that doesn’t mean I’m abandoning ship! My plan for 2025 is to scale back slightly:

I’ll share one post every three months, combining portfolio and watchlist updates.

When time permits, I’ll also dive deeper into individual companies, short investment theses, or updates triggered by specific events—just like my recent post on Teleperformance.

I’m excited to continue sharing insights and learning together with all of you. Thank you for being part of this journey, and here’s to navigating the markets and uncovering opportunities together in 2025. Wishing you fair winds and plenty of prosperity ahead!

Disclaimer: Please note that the information presented here is for informational purposes only and should not be considered financial advice. Always consult with a financial professional before making investment decisions.

great review! Good job.

Very brave on the PayPal levered trade.

From my point of view you could maybe simplify by adding a more passive investment strategy without options and trading in and out, just holding this basked of compounders, with a few errors and some big winners, should do well and give you more time!